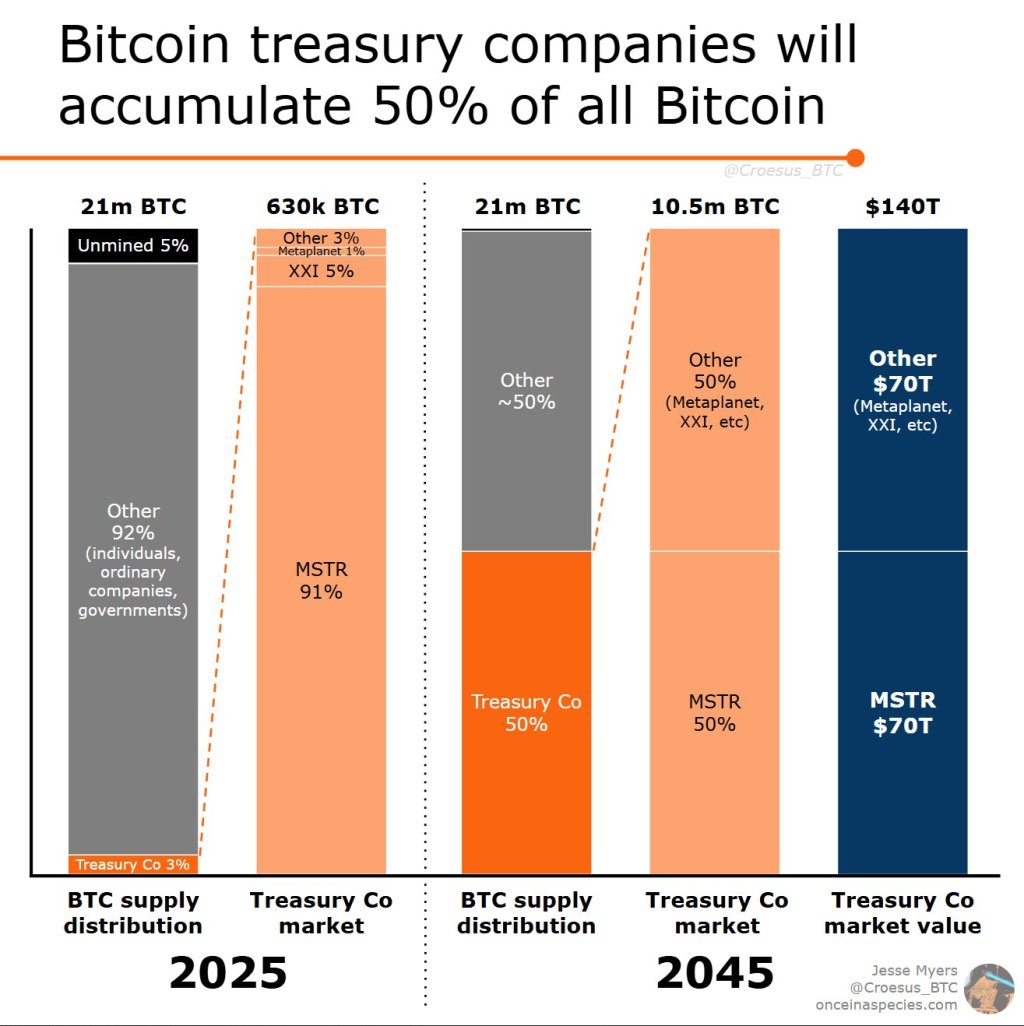

Jesse Myers, the co-founder and chief operating officer of institutional custodian Onramp, ignited a fresh debate on corporate bitcoin strategy last night when he told his 92,400 followers on X that “Strategy will own $70 trillion of Bitcoin in 20 years, making it by far the most valuable company in the history of the world,” before adding that “Bitcoin Treasury Companies will hold 50% of all BTC, way more than most Bitcoiners are prepared for.”

Treasury Firms Aiming for 10.5 Million Bitcoin

In a thread on X, Myers sketched a scenario in which dedicated treasury vehicles—public companies whose raison d’être is to arbitrage the spread between cheap fiat funding and a growing BTC balance—become the dominant marginal buyers of the asset through 2045. His starting premise borrows directly from Michael Saylor:

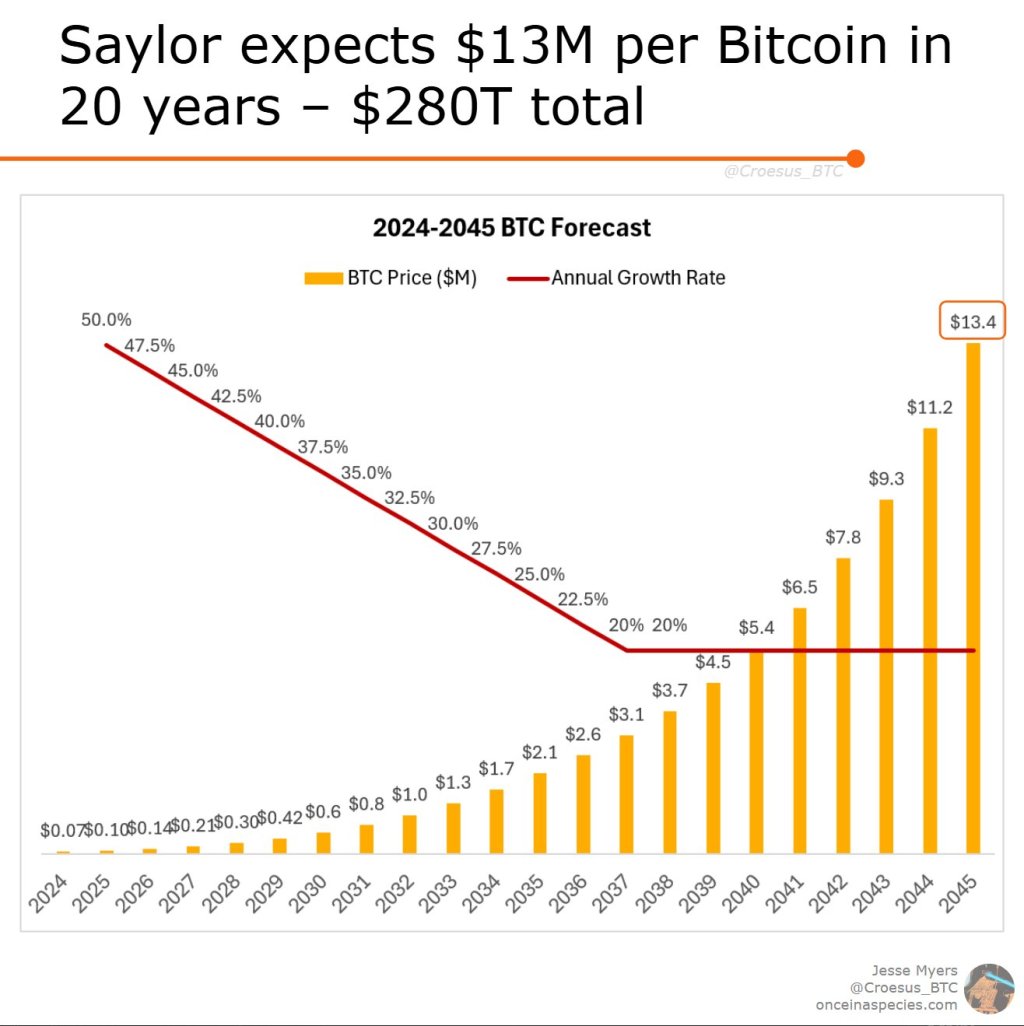

“Half of all capital is simply looking for the best store of value. Bitcoin is the best SoV asset. SoV capital will osmotically flow towards Bitcoin,” Myers quoted Saylor as saying, before noting that the MicroStrategy founder projects a $280 trillion market capitalization within two decades, implying roughly $13 million per coin.

The intellectual backdrop matters because MicroStrategy—renamed Strategy in February—has already offered a proof-of-concept. The Virginia-based firm holds about 550,000 BTC today after accelerating purchases through a series of high-yield preferred-stock programmes.

The funding engine is now institutional. Two preferred instruments—Strike (STRK) and Strife (STRF)—offer coupons of eight percent and ten percent respectively, terms rarely available in traditional fixed-income markets for an investment-grade name. Net proceeds of $1.27 billion from the twin offerings are expressly earmarked for further BTC purchases.

Myers argues that such structures turn Strategy into a “capital pump” that channels yield-hungry bond flows—an estimated $318 trillion pool, by his count—into BTC. If growth tracks Saylor’s trajectory, Strategy alone would accumulate five million Bitcoin, or nearly one quarter of eventual supply, by 2045.

Japan’s Metaplanet is already following suit. The Tokyo-listed investment house lifted its treasury to 7,800 BTC this week after a ¥16.2 billion bond sale, stating a target of 10,000 BTC before year-end. Similar moves by major vehicles such as 21 Capital – which has significant backing from major players including SoftBank, Tether, and Bitfinex – suggest, in Myers’s words, “the birth of an industry.”

His distribution model places treasury companies at three percent of supply today (about 630,000 BTC) but projects a fifty-percent share—10.5 million BTC—by 2045, leaving roughly equal portions for governments, traditional corporations, and individuals. At a $13 million spot price, that corporate half would be worth $140 trillion; Strategy’s slice, by his estimate, would top $70 trillion.

At press time, BTC traded at $110,816.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Credit: Source link