Join our Telegram channel to stay updated on breaking news coverage

The global non-fungible token market took a hit after the United States Securities and Exchange Commission (SEC) failed to appeal a court overturning of its decision not to let Grayscale convert its Bitcoin Trust into a more investor-friendly exchange-traded fund. A sharp reaction has been expressed today. ,

NFT sales increased by 25% in the last 24 hours

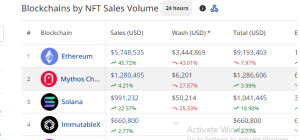

Data compiled by CryptoSlam.io, an on-chain data aggregator, indicates that the global non-fungible token market is up 25% today. In the last 24 hours, the NFT market has attracted $9.6 million worth of trading sales. Currently, the number of investors buying NFTs has also increased by 6%.

In light of the bullish news, non-fungible token collections hosted on the Ethereum network are up a bit today. Over the past 24 hours, Ethereum-based NFTs have attracted $5.7 million worth of trading sales, representing a 45.32% increase from the previous day.

Digital collectibles hosted on the Mythos Chain and Solana blockchains have seen a slight surge today. Over the past 24 hours, Mythos Chain and Solana-based NFTs have recorded trading sales volumes of $1.2 million and $1 million, respectively. Mythos Chain NFTs are up 4.21%, while Solana are up 22.57%.

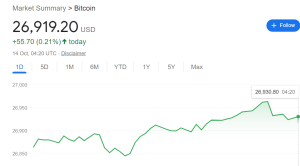

Bitcoin price increased by 55% in the last 24 hours

After the news came out, the major crypto Bitcoin has also expressed a sharp reaction today. Over the past 24 hours, the largest digital asset by market capitalization has increased by 55% compared to the previous day. After a short rally, the digital asset “Bitcoin” has now consolidated around $26,919.

The Crypto Market Regulatory Commission had until midnight on Friday to decide whether to challenge the initial court ruling, but the Commission deliberately let that deadline come and go without appealing its case, which would have been worse than the previous decision. indicates his satisfaction.

Early last year, American digital currency asset management company Grayscale, which manages one of the world’s largest crypto funds, joined forces to transform its Bitcoin Trust into a more investor-friendly exchange-traded fund “ETF.” Had applied to the State Securities and Exchange Commission.

Grayscale Vs. SEC legal battle

In June 2022, the crypto asset management firm filed a lawsuit after the Regulatory Commission rejected its proposed Bitcoin ETF without reason. In August 2023, a three-judge panel of the District of Columbia Court of Appeals in Washington ruled that the SEC was wrong to reject Grayscale’s proposed Bitcoin ETF. Circuit Judge Neomi Rao commented:

“The United States Securities and Exchange Commission recently approved trading of two Bitcoin futures funds on national exchanges, but declined to approve Grayscale’s Bitcoin fund. This was an invalid and capricious rejection and should be reviewed.

Meanwhile, it is uncertain whether the United States Securities and Exchange Commission will move forward and approve the Grayscale ETF. Grayscale ETF approval has important merits in the crypto market as it will reflect the future of crypto. Since crypto and NFTs are somewhat related, the approval will also dramatically impact the NFT market.

Related NFT News:

New Crypto Mining Platform – Bitcoin Minetrix

- Audited by Coinsult

- Decentralized, secure cloud mining

- earn free bitcoin daily

- Native Token on Presale Now – BTCMTX

- Staking Rewards – Over 1,000% APY

Join our Telegram channel to stay updated on breaking news coverage

Source

Credit: Source link