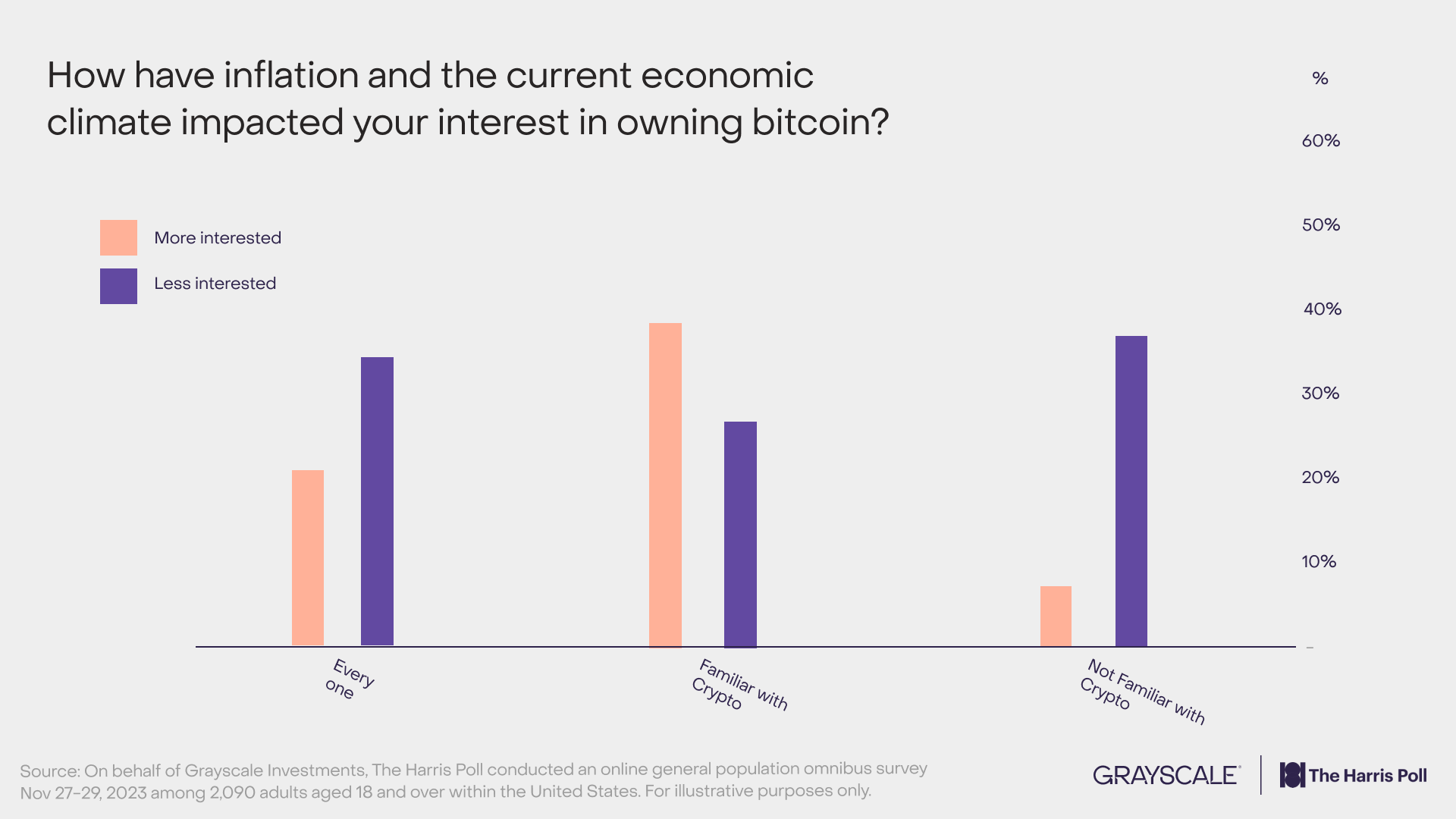

Amid the buildup to the approval of crypto ETFs and concerns about financial stability and inflation, many young individuals are turning to crypto investments, viewing them as a bulwark against inflationary pressures in the long term, according to a new survey by Grayscale.

The research also highlights that consumers with a comprehensive understanding of cryptocurrency tend to be more inclined toward crypto asset investments.

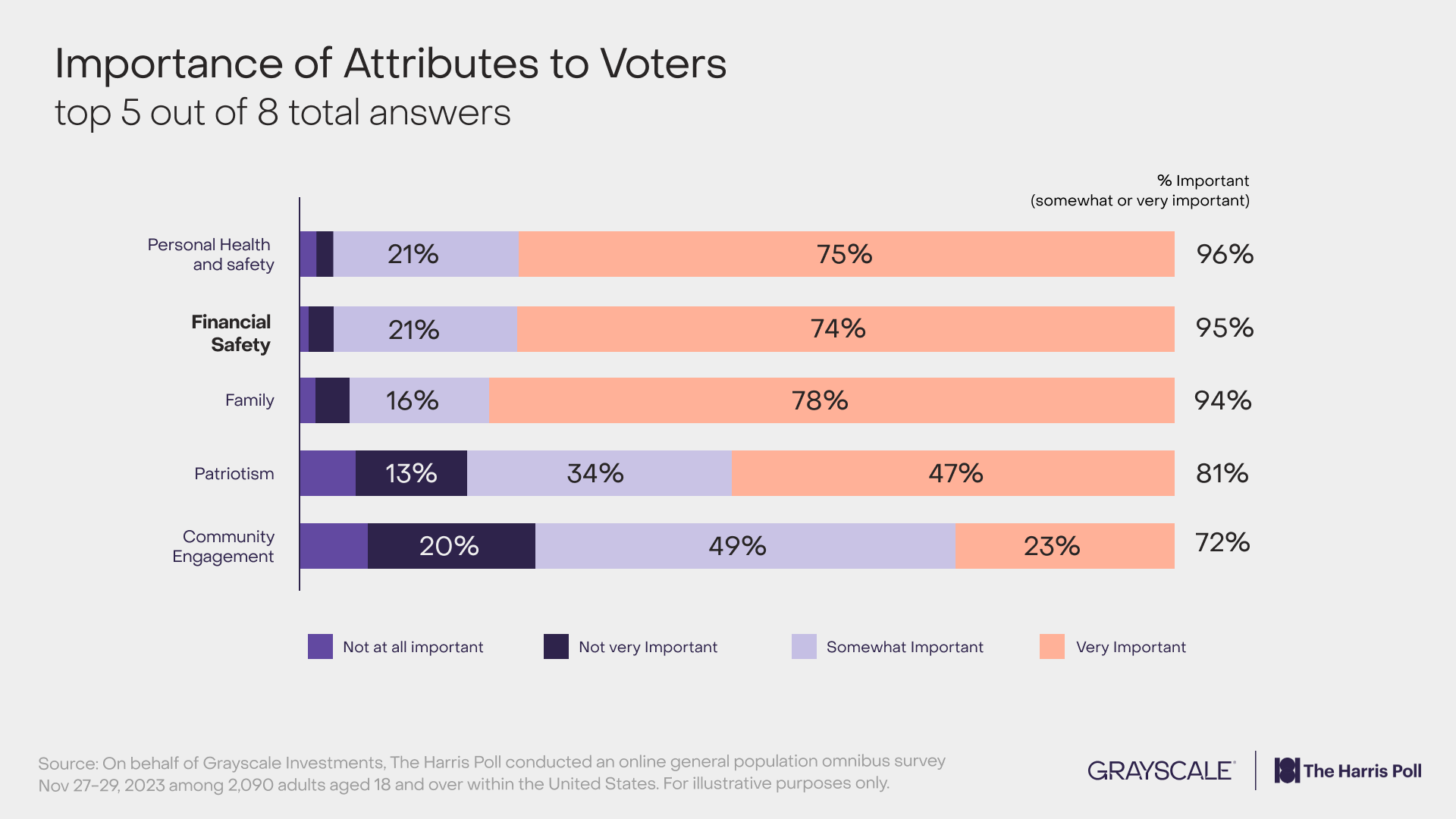

This growing interest in digital assets is also influencing consumers’ preferences to an extent where it plays a significant role in their consideration of new leaders vying for a position in the upcoming presidential election.

Half of the young voters — Gen Z and Millennials who own more crypto than equities – aim to choose candidates knowledgeable about and supportive of the cryptocurrency industry. According to the report, this prerequisite takes center stage in part due to the younger generation’s belief in the interconnected future of finance, cryptocurrency, and blockchain technology. In addition, they envision this convergence as a pathway toward a financial system outside the traditional structure that can provide a more financially resilient environment for consumers at large.

While some continue to see Bitcoin’s scarcity as a hedge against inflation, others label it a marketing gimmick. The former assumption is still unverified, especially in light of last year’s crypto market contraction following the collapse of FTX and other major players that further prompted regulatory actions on the resilience of crypto investments. Bearing this in mind, the other half (46%) of consumers are exercising caution and abstaining from venturing into cryptocurrency investments until solid policies and regulatory measures are put into place to provide a clearer path forward.

40% of investors, however, intend to incorporate crypto into their future portfolios as dialogues concerning regulation have started to gain ground globally. The European crypto market adopted a regulatory framework on markets in crypto-assets (MiCA) in June 2023 to regulate its crypto-asset markets. MiCA brings forth a standardized legal framework across Europe for crypto-asset markets, paralleling the tracking of crypto-asset transactions to traditional money transfers. Non-compliance could incur substantial costs, including million euro penalties and fines of up to 12.5% of annual turnover. Though designed for the EU, the rules are gaining acceptance globally, encouraging other regions to follow suit.

Analysts and industry experts harbor an optimistic outlook for crypto stocks and investment products in the foreseeable future in light of anticipated rate cuts by the Fed that reverberated across the crypto market, boosting stocks. Bitcoin exceeded the $42,000 mark, hitting a 20-month high in December, while Coinbase stock and shares of Bitcoin miner Marathon Digital saw a surge of 7.8% and 12.6%, respectively.

Blockchain equities collectively saw an influx of $126 million in a week last month, while digital asset investment products experienced their eleventh consecutive week of inflows totaling $43 million.

“High real interest rates have weighed on Bitcoin’s valuation, so we expect rate cuts to help support crypto markets. A soft landing for the U.S. economy, Fed rate cuts, and a potentially contentious presidential election should all be macro tailwinds for Bitcoin in 2024,” said Zach Pandl, managing director of research at digital asset manager Grayscale.

On Wednesday, the SEC approved the inaugural U.S.-listed exchange-traded funds (ETFs) designed to mirror the performance of bitcoin. This decision is anticipated to act as a catalyst for the transformation of the Grayscale Bitcoin Trust, holding around $29 billion in cryptocurrency, into a full-fledged ETF. Additionally, it opens the gates for the introduction of competing funds from major players in the financial sector, including BlackRock’s iShares and Fidelity. Investors can expect the initial trading of these funds to kick off on Thursday.

“If we see the likes of BlackRock and Fidelity launch Bitcoin ETFs, we can expect a lot of other traditional financial institutions to enter the crypto markets as well,” said Henrik Andersson, chief investment officer at Apollo Crypto.

This regulatory nod marks a significant milestone in the integration of cryptocurrency into capital markets. Crypto advocates are optimistic that the advent of bitcoin ETFs will likely propel a surge in demand for the asset class and attract a diverse array of investors who had previously been hesitant due to lingering concerns about custody practices and the safety of crypto exchanges.

Credit: Source link