Binance’s Navigating the Inscription Landscape report discusses three protocols that can further expand Bitcoin’s (BTC) footprints into non-fungible token (NFT), decentralized finance (DeFi), and tooling sectors.

In 2023, the Bitcoin ecosystem saw transformative growth via the rise of inscriptions and BRC-20 tokens, which redefined the network’s capabilities. These developments fueled a market resurgence and ignited a speculative frenzy reminiscent of meme coins, significantly impacting transaction activities and fees on the Bitcoin network.

3 Protocols Can Transform the Bitcoin Network

Bitcoin inscriptions, though still emerging, have expanded into various sectors, including DeFi, NFTs and tooling. According to Binance, this is evident in several innovative projects that have come to the fore.

bitSmiley, for instance, represents a pivotal development in Bitcoin’s DeFi infrastructure, combining stablecoin, lending, and derivatives into a cohesive protocol. The launch of bitUSD, a BTC-backed stablecoin, underlines a significant stride towards integrating conventional financial instruments within the Bitcoin ecosystem.

On the other hand, Liquidium is a new peer-to-peer lending protocol. It allows loans using Bitcoin assets like inscriptions and BRC-20s as collateral. This shows the rising demand for the Bitcoin network in DeFi. It also highlights the economic potential of inscriptions.

“Much like the operational model of other peer-to-peer lending platforms, Liquidium allows borrowers to collateralize their ordinals according to the terms they find acceptable, while lenders provide BTC loans that align their risk-reward preferences,” Binance explained.

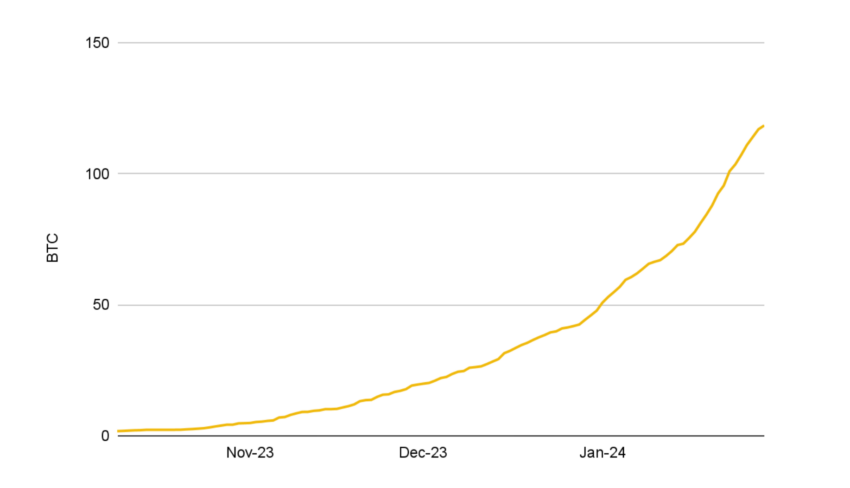

Additionally, Binance revealed that Liquidium has facilitated transactions exceeding 118 BTC. Since its inception, it has processed over 2,700 loans that are either completed or currently active.

Read more: What Are BRC-20 Tokens? Everything You Need To Know

Finally, Portal stands out as a cross-chain liquidity solution, focusing on decentralized exchange and wallet services. By facilitating BRC-20 swaps to other chains, Portal underscores the potential for Bitcoin’s integration into the broader blockchain ecosystem, enhancing its utility and accessibility.

The impact of inscriptions and BRC-20s extends beyond Bitcoin, with several EVM-compatible chains adopting similar protocols. Despite the inherent capabilities of these chains for handling fungible and non-fungible tokens, inscriptions have witnessed considerable transaction activity driven partly by speculative interests.

Read more: Bitcoin NFTs: Everything You Need To Know About Ordinals

However, critics and proponents of inscriptions and BRC-20s offer divergent viewpoints, with the former pointing out the network congestion and elevated fees, while the latter sees them as a golden opportunity for Bitcoin’s evolution, especially in enhancing the ecosystem’s scalability and security.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Credit: Source link