Bitcoin rallied 4%, with global crypto market capitalization up 3% to $2.7 trillion.

Hedge funds are betting big against Bitcoin in the futures markets, possibly looking to profit from elevated funding rates, as the most valuable cryptocurrency continues to trade sideways.

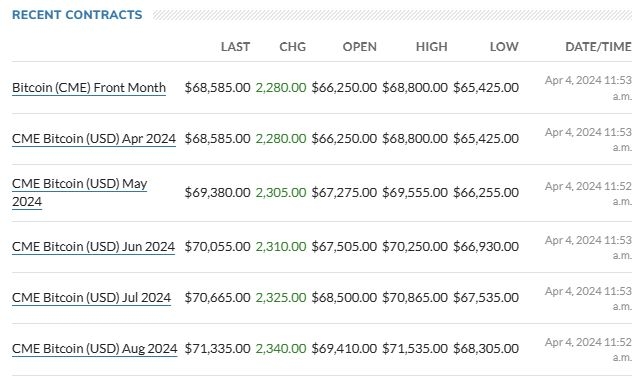

Funds have built up record short positions in Bitcoin futures, according to data shared by zerohedge. As each CME Bitcoin futures contract represents 5 BTC, these institutions are reportedly short more than 80,000 BTC, notionally worth $5.4 billion at today’s prices.

One possible explanation for the extreme positioning is basis trades, which look to profit from the difference between spot and futures prices. By buying spot Bitcoin and opening an equal-sized short futures position, traders can capture the differential when prices converge upon expiry. June futures are currently trading at a 3% premium.

Elevated perpetual funding rates sweeten the deal as traders get paid to hold their short positions — a source of yield being leveraged by Ethena’s controversial new ‘synthetic dollar.’

Markets Bounce Back

Crypto markets have recovered some of the week’s losses, with Bitcoin rallying 3% in the past 24 hours to trade around $68,000. Ether is up 1% at $3,375.

Among the top 100 digital assets by market capitalization, Ethereum Layer 2 network Mantle and veteran DeFi lender MakerDAO are today’s best performers, notching up gains of 12% and 7%, respectively. MKR is trading above $4,000 for the first time since May 2021, boosting its valuation to nearly $4 billion.

Cross-chain interoperability protocol Wormhole’s W token, which launched yesterday, is down 23% today, likely due to selling pressure from airdrop recipients.

Start for free

Credit: Source link