Italy is preparing to enhance its surveillance of cryptocurrency markets as part of its adherence to the European Union’s Markets in Crypto-Assets (MiCA) regulatory framework.

This regulatory measure, initially passed in 2022, aims to ensure stricter oversight of the digital asset markets, targeting insider trading and market manipulation.

Challenges for Blockchain Firms and DeFi Protocols

The new decree mandates fines ranging from 5,000 to 5 million euros ($5,400 to $5.4 million) depending on the severity of the violations. This step is part of a broader effort to ensure compliance and maintain market integrity.

The MiCA regulatory framework poses significant challenges for blockchain firms and decentralized finance (DeFi) protocols. These protocols must choose between fully decentralizing their networks or adhering to the framework’s Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

Fully decentralized networks are exempt from MiCA’s reporting requirements. However, many DeFi protocols use foundations and intermediaries to moderate their communities, risking non-compliance with MiCA’s definition of decentralization.

As a result, these protocols face the dilemma of either fully decentralizing or requiring users to submit verification data, a difficult decision for many participants.

Adjustments by Centralized Exchanges in Response to MiCA

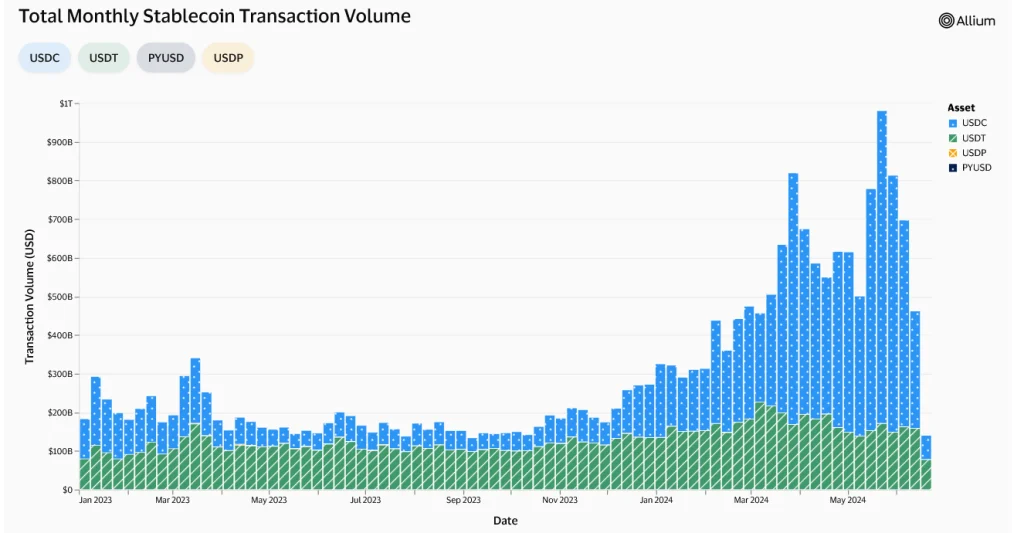

In response to MiCA, centralized exchanges like Binance have begun adapting their operations. Binance recently informed its European customers of a shift towards a model that categorizes stablecoins as either authorized or unauthorized, in line with MiCA’s requirements.

The exchange plans to transition users to this new system gradually. Binance CEO Richard Teng emphasized that the company is not delisting these stablecoins from spot markets but is limiting their availability for certain products to European users.

Similarly, Uphold has made changes to comply with the EU’s regulatory changes, announcing the delisting of six stablecoins: Tether (USDT), Frax Protocol (FRAX), Pax Dollar (USDP), Dai (DAI), TrueUSD (TUSD), and Gemini Dollar (GUSD).

Despite the increasing regulatory pressure in Europe, experts remain optimistic about the future of stablecoins. Many believe that stablecoins could potentially alleviate debt crises caused by overprinted fiat currencies.

Former U.S. House of Representatives Speaker Paul Ryan recently argued that stablecoins could help mitigate economic shortfalls linked to the debt-laden U.S. dollar.

The Promising Future of Stablecoins

Jeremy Allaire, CEO of stablecoin issuer Circle, echoed this sentiment. He predicted that stablecoins would represent 10% of the money supply within the next decade.

Allaire highlighted that many of the world’s largest payment companies are already using this technology and exploring ways to expand their usage. He emphasized that the benefits of public blockchains and stablecoins are becoming increasingly apparent.

Allaire believes the potential market size for stablecoins is in the “billions,” and that deploying digital dollars on blockchains can fulfill promises of financial inclusion, lower remittance costs, and enable seamless cross-border commerce.

He projected that cryptocurrency adoption could grow to billions of users across millions of applications over the next ten years. During this period, more commerce and financial transactions could be executed via smart contracts on public blockchain infrastructure.

Allaire also suggested that some on-chain organizations might outperform multinational corporations within this timeframe, although he did not provide specific details on how or in which sectors this would occur.

Within the framework established by MiCA, this forward-looking perspective underscores the transformative potential of stablecoins and blockchain technology in the global financial system.

Credit: Source link