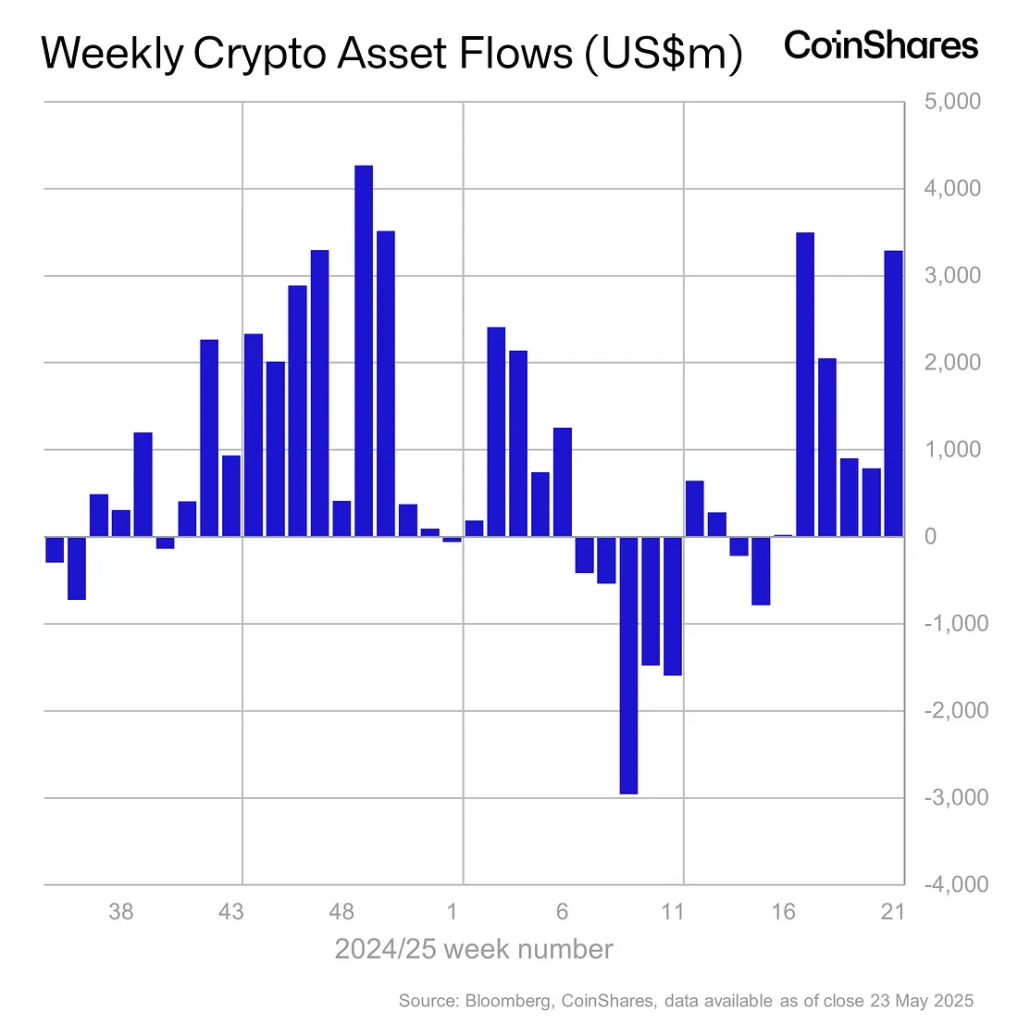

Bitcoin is holding at $109,250 as ETF inflows surge and macro uncertainty grows. Data from CoinShares shows institutions poured $3.3 billion into Bitcoin ETFs last week alone, $10.8 billion YTD.

This is Bitcoin’s growing appeal as a portfolio diversifier with US Treasury yields rising and fiscal outlook cloudy. US led the inflows with $3.2 billion, Australia, Hong Kong and Germany followed with smaller allocations.

But not all flows were bullish: XRP saw outflows of $37 million, breaking its 80 week inflow streak as Bitcoin and Ethereum took center stage.

Market Sentiment: Institutions Strong, Retail Eyes Altcoins

Institutions are betting on Bitcoin as a macro hedge, retail is getting cautious. Social media is shifting to smaller cap tokens like FloppyPepe (FPPE) and Fartcoin (FARTCOIN) with influencers highlighting their upside as Bitcoin consolidates.

On-chain data from CryptoQuant shows 99% of BTC supply is in profit, a level associated with market euphoria but also profit taking.

As BTC holds above $109K, traders are wondering if the rally can continue with macro uncertainty growing.

High US Treasury yields, potential Moody’s downgrade and geopolitical concerns are keeping investors on edge. But Bitcoin’s resilience in these conditions reinforces its dual role as risk asset and safe-haven.

Technical Outlook: Key Levels for Bitcoin Price

Bitcoin 2 hour chart is consolidating just above the 50 EMA at $108,731 and the ascending trendline from $102,190. The 0.236 Fibonacci level at $109,653 has been a pivot with small bodied candles and doji formations showing market indecision.

MACD is hinting at a bullish crossover with the MACD line above the signal line and green histogram bars growing but momentum confirmation is pending.

- Resistance: $109,653, $111,935, $113,300

- Support: $108,731 (50 EMA), $107,078, $105,905A break above $109,653 confirmed by bullish engulfing or three white soldiers and strong volume could take us to $111,935 and $113,300. A failure to hold above $108,731 could see a pullback to $107,078 or $105,905.

For now, wait for clear signals before entering and Bitcoin’s resilience in macro headwinds is short term bullish.

BTC Bull Token Presale Approaches $7.33M Mark as 65% APY Staking Draws Interest

With BTC/USD dipping below $110,000, attention is shifting to altcoins like BTC Bull Token ($BTCBULL). So far, $6.38 million has been raised, with the next price jump approaching quickly.

Bitcoin Rewards and Supply Reductions

BTC Bull Token operates with a built-in system: the higher BTC’s price, the more BTC airdrops are distributed to token holders. Notably, presale participants receive priority. The system also features:

- Token burns every $50K BTC increase, reducing supply.

- Current token price at $0.00253 before the next bump.

This approach aligns token value with BTC/USD’s price moves while maintaining scarcity through programmed burns.

Staking Terms for Passive Returns – BTCBULL’s staking pool holds 1.62 billion tokens offering 65% APY, with:

- No lockup periods or fees.

- Full access to funds at any time.

This structure appeals to holders looking for yield without complex requirements or risk of illiquidity.

Momentum Before the Cap Fills

With just over $1 million remaining in the presale, buyers are positioning early. The token’s mechanics of BTC-tied rewards, supply adjustments, and staking options are driving participation.

Key figures:

- USDT raised: $6,384,454/ $7,332,195

- Token price: $0.00253

BTCBULL offers a whopping ~65% APY on its Ethereum-based staking pool (currently holding 1.61B BTCBULL), with no lockups or withdrawal fees. That means passive yield — with full liquidity.

The post Bitcoin Price Prediction: BTC Holds $109K Amid ETF Inflows and Macro Shifts appeared first on Cryptonews.

Credit: Source link

— UTXOs (Unspent Transaction Outputs) are the technical mechanism that ensures a single BTC can only be spent once on the blockchain. They also allow us to assess unrealized profits on all unspent…

— UTXOs (Unspent Transaction Outputs) are the technical mechanism that ensures a single BTC can only be spent once on the blockchain. They also allow us to assess unrealized profits on all unspent…