Kimchi coins, low-cap altcoins popular among some sections of the South Korean crypto community, have seen rapid growth in the past few days.

Experts say this is mainly due to the buzz around the country’s new government-led plan to launch a won-backed stablecoin.

But insiders have urged investors to treat the tokens’ rapid rise with caution, noting that previous kimchi coin price rises have proven ephemeral.

Kimchi Coins: Riding the Stabelcoin Wave?

The South Korean media outlet Biz Watch reported that the new government’s won-pegged stablecoin has become a “hot topic” in both the financial sector and blockchain industry, with “related” coins attracting attention.

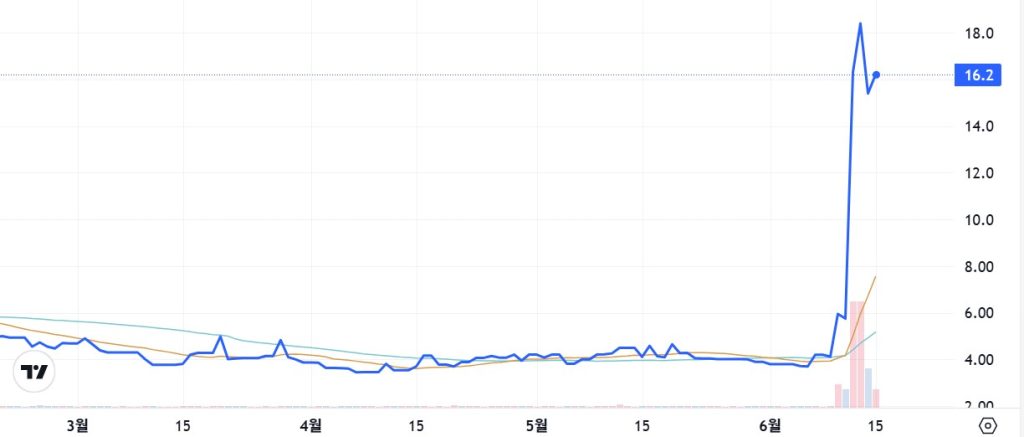

The outlet noted that while high-cap cryptoassets like Bitcoin (BTC) and XRP are experiencing price stagnation, “only certain domestic coins have been showing abnormal price surges.”

Examples include MEVerse (MEV), which shot up from around KRW 3 to KRW 20 won, as well as fanC (FANC), which rose from KRW 5 to KRW 13 won.

In the same period, Wrapped Nine Chronicle Gold (WNCG) increased from around KRW 29 won to KRW 57 won.

Tokens like BORA and Storm X (STMX) have also seen price rises of over 60% on domestic crypto exchanges.

Coins Remain Popular in South Korea

The outlet explained that MEV is a coin issued by the KOSDAQ-listed gaming and entertainment company Me2On.

FanC, meanwhile, was issued by CELEBe, a Seoul-based startup that specializes in mobile app and social media-related services.

In both cases, 99% or more of the coins’ global trading volume takes place on domestic exchanges like Bithumb and Coinone. Biz Watch wrote:

“Many of these coins have been ignored by investors for a long time. Their trading volumes and market prices have been at rock bottom. As market interest has cooled, it has become harder to find information about project activity levels and technological capabilities.”

Experts Issue Warning

Apywa is a South Korean analyst that provides evaluation grades for domestic and international projects. It grades FANC at C-, with 41.48 points out of 100.

By contrast, it rates BTC at A+ with almost 95 points. MEV scores 45.83 points (grade C), with STMX receiving a B- and BORA a B.

Apywa deducts points for coins that show relatively low levels of community activity and development activity.

While it is unclear if any of the projects have any relationship with the government’s own stablecoin plans, experts think the price rise may be attributable to possible relationships with overseas stablecoins such as Tether (USDT) or USD Coin (USDC).

In other instances, these projects’ coins may have certain payment and/or settlement functions that have caught the eye of some traders.

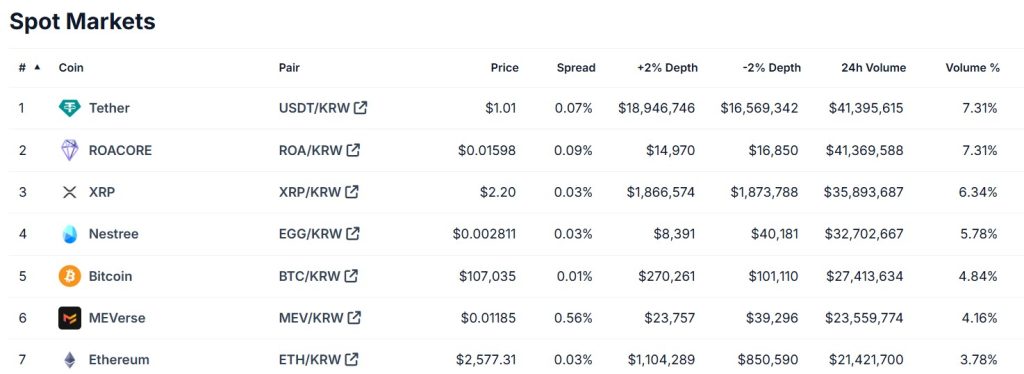

At the time of writing, MEV trading volumes on Bithumb were outstripping those of Ethereum (ETH) and Solana (SOL).

Lessons from the Past?

However, experts told the same media outlet they were concerned about market confusion and possible investor damage risks. An unnamed securities firm employee said:

“With the government’s push to issue a won-denominated stablecoin, fintech and blockchain companies are announcing business plans, one after another. They are claiming relevance, and their prices are rising.”

A crypto industry insider added:

“In the past, projects like Paycoin (PCI) soared when local government stablecoins were a big thing. They then went on to drop by more than 30% in a few days. In the same way, coins related to won stablecoins could also plummet at any time. Investors should carefully consider the operational status and business viability of projects. People should invest with caution.”

The post Kimchi Coins Booming on South Korean Stablecoin News – But Experts Urge Caution appeared first on Cryptonews.

Credit: Source link

Bank of Korea governor is likely to discuss the quick issuance of Won-based stablecoins with the country's commercial bank heads.

Bank of Korea governor is likely to discuss the quick issuance of Won-based stablecoins with the country's commercial bank heads.