- Bitstamp announced that starting September 25, all staked assets will be unstaked and credited to users’ accounts.

- The concerns regarding offering staking services emerged after the SEC penalized crypto exchange Kraken for $30 million in February 2023.

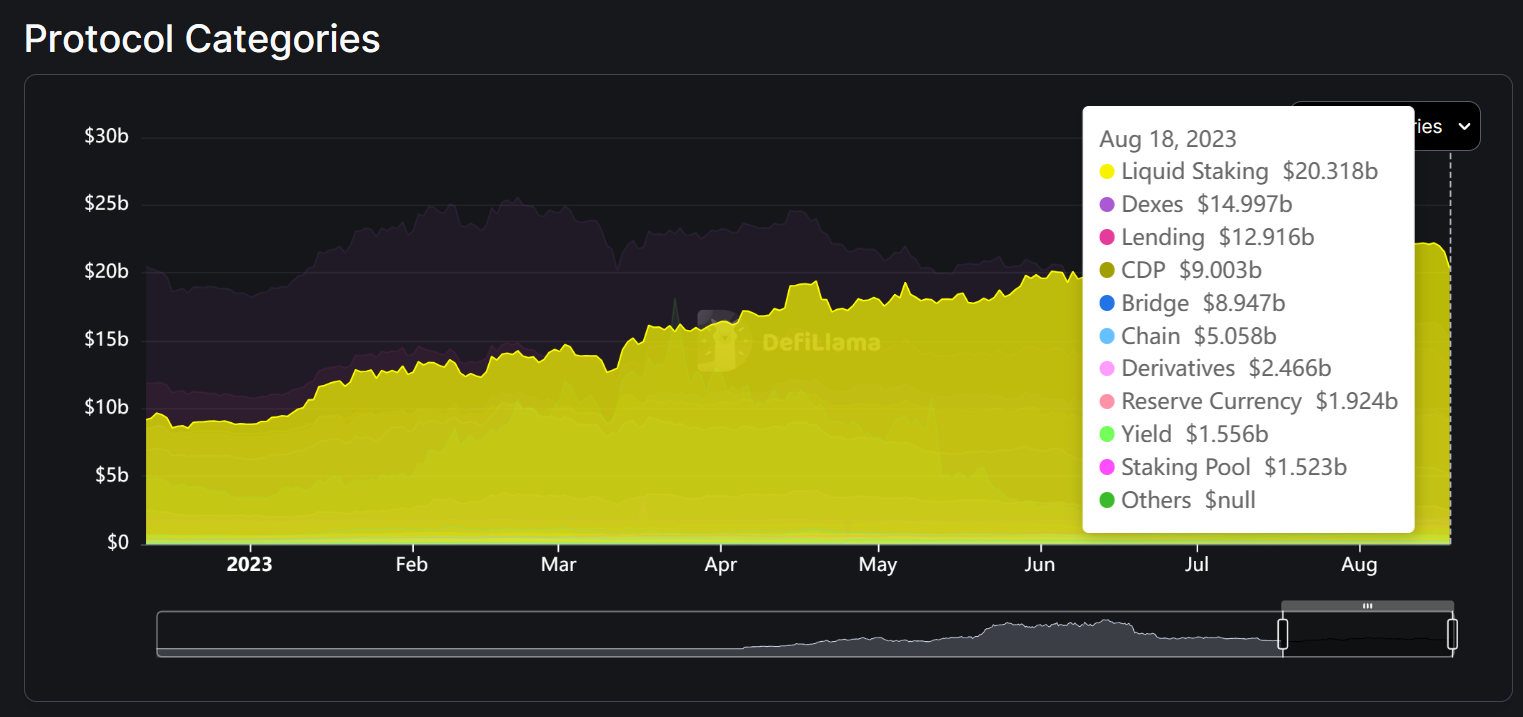

- Since the Shapella upgrade, liquid staking has seen a surge in the DeFi market, becoming the biggest category of protocols.

The United States has been facing criticism for its lack of crypto regulation, especially since the European Union approved the MiCA (Markets in Crypto Assets) bill this year. The Securities and Exchange Commission (SEC) has failed to provide a clear answer when it comes to the status of cryptocurrencies, and the impact is being felt by users in the country.

Bitstamp terminates Ethereum staking

One of the biggest cryptocurrency exchanges in the world, Bitstamp, announced this Tuesday that it would be ending its Ethereum staking service. Exclusive only to the United States, users would have until September 25 to earn rewards on their staked assets, after which the tokens would be unstaked and deposited back into the accounts of users.

The exchange, in a statement, cited the regulatory hurdles in the United States as the reason for this decision. The company iterated,

“Considering current regulatory dynamics in the US, we’ve made the decision to discontinue staking for customers residing in the United States.

Earlier this month, Bitstamp also discontinued offering seven other cryptocurrencies, including Polygon (MATIC) and Solana (SOL). The reason, while unspecified, was speculated to be the SEC’s given status of these assets as “unregistered securities”.

Update for our US users

Starting August 29: AXS, CHZ, MANA, MATIC, NEAR, SAND, and SOL trading will be halted after evaluating recent market developments.

Execute any open trades. Holding and withdrawing tokens afterwards will be unaffected.

More info:…

— Bitstamp (@Bitstamp) August 8, 2023

The SEC has already been pursuing legal actions against crypto service providers for offering unregistered securities and violating other securities laws. This included both of the biggest crypto exchanges in the world – Binance and Coinbase.

The staking aspect has also been at the regulatory body’s crosshair since February after first penalizing Kraken with a $30 million fine. Consequently, the exchange ceased offering crypto-staking services.

Read more – Crypto exchange Kraken set to pay $30 million fine to SEC and cease crypto staking service

Staking in the DeFi market

This is a concern for investors as staking decentralized applications (Dapps) are currently the biggest protocols in the Decentralized Finance (DeFi) market. Since Ethereum’s Shanghai upgrade in April, which enabled unstaking for validators, liquid staking noted a surge.

DeFi market total value locked distribution

It did not take the category too long to take over the number one position from DEXes and Lending protocols. At the time of writing, liquid staking protocols hold nearly $21 billion in total value, which could decline significantly if the SEC was to pursue staking service providers.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14:

For institutional investors or over-the-counter sales, XRP is a security.

For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token.

While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at.

Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say.

Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation.

While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.

Like this article? Help us with some feedback by answering this survey:

Credit: Source link