Blockchain Insurance Market

Anticipated Growth in Revenue:

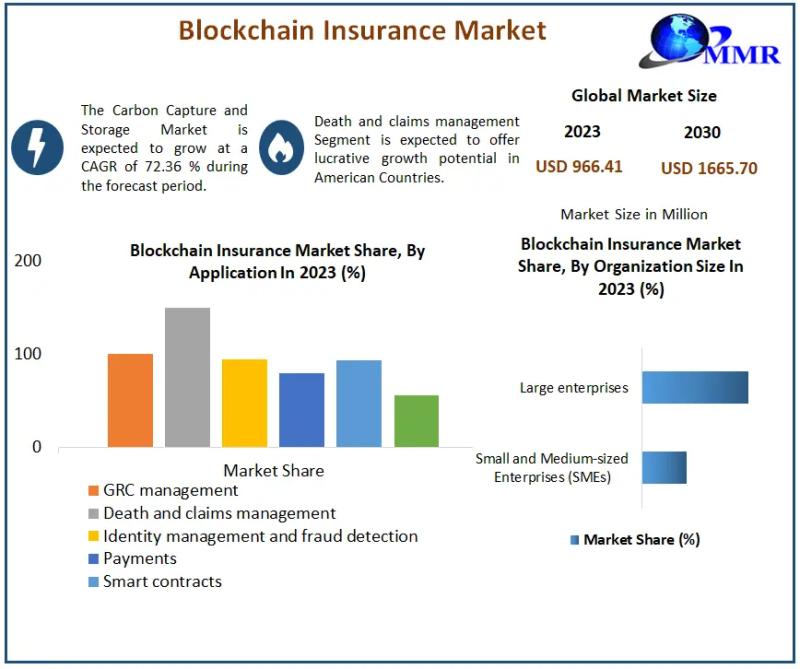

Blockchain Insurance Market size was valued at USD 966.41 Million in 2023 and the total Blockchain Insurance revenue is expected to grow at a CAGR of 72.36 % from 2024 to 2030, reaching nearly USD 1665.70 Million by 2030.

Blockchain Insurance Market Overview:

The blockchain insurance market is rapidly evolving as insurers and technology providers leverage blockchain’s decentralized ledger technology to enhance transparency, security, and efficiency in the insurance industry. Blockchain enables streamlined processes for policy issuance, claims handling, and underwriting by securely storing and verifying data across multiple parties in real-time. This technology enhances trust among insurers, reinsurers, and clients through immutable records and smart contracts that automate claims processing and reduce fraud risks. As blockchain adoption grows, it promises to revolutionize traditional insurance models by improving operational resilience, reducing costs, and providing more personalized insurance products tailored to customer needs.

𝐃𝐢𝐬𝐜𝐨𝐯𝐞𝐫 𝐄𝐱𝐜𝐞𝐥𝐥𝐞𝐧𝐜𝐞: 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐘𝐨𝐮𝐫 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐇𝐞𝐫𝐞: https://www.maximizemarketresearch.com/request-sample/11489/

Blockchain Insurance Market Trends:

In the blockchain insurance market, several key trends are shaping its evolution. Firstly, there is a growing emphasis on interoperability and standardization of blockchain platforms to facilitate seamless integration across various stakeholders in the insurance ecosystem. Secondly, smart contracts are gaining traction for automating claims processing, reducing administrative costs, and enhancing transparency through self-executing agreements based on predefined conditions. Moreover, there is increasing adoption of blockchain for parametric insurance, where payouts are triggered automatically based on predefined triggers such as weather data or IoT sensor readings, streamlining the claims settlement process. Lastly, regulatory advancements and frameworks are being developed to address legal and compliance challenges, fostering greater trust and scalability in blockchain-enabled insurance solutions.

What are Blockchain Insurance Market Dynamics?

The dynamics of the blockchain insurance market are driven by several factors reshaping the industry landscape. Firstly, blockchain technology offers enhanced security and transparency by decentralizing data storage and verification, thereby reducing fraud and enhancing trust among insurers, reinsurers, and customers. Secondly, there is a notable shift towards cost efficiency and operational streamlining through smart contracts, which automate policy management, claims processing, and underwriting processes. Moreover, the market is witnessing increased collaboration among insurers, technology providers, and regulators to develop interoperable blockchain solutions that meet regulatory requirements and improve industry standards. Additionally, the emergence of innovative insurance products, such as parametric insurance and microinsurance, powered by blockchain’s ability to facilitate real-time data sharing and automated payouts, is expanding market opportunities and catering to diverse customer needs.

𝐇𝐚𝐯𝐞 𝐐𝐮𝐞𝐬𝐭𝐢𝐨𝐧𝐬? 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐇𝐞𝐫𝐞 𝐟𝐨𝐫 𝐄𝐱𝐩𝐞𝐫𝐭 𝐆𝐮𝐢𝐝𝐚𝐧𝐜𝐞: https://www.maximizemarketresearch.com/inquiry-before-buying/11489/

Blockchain Insurance Market Opportunities:

The blockchain insurance market presents compelling opportunities for industry participants to innovate and differentiate their offerings. One major opportunity lies in enhancing operational efficiency and reducing costs through the adoption of blockchain technology, which streamlines processes such as policy issuance, claims settlement, and regulatory compliance. Additionally, blockchain enables insurers to offer more personalized and flexible insurance products by leveraging real-time data and smart contracts to tailor coverage based on individual risk profiles and changing customer needs. Another significant opportunity lies in improving transparency and trust in insurance transactions, which can attract a broader customer base by addressing concerns over data security and fairness in claims processing. Furthermore, blockchain facilitates the development of new business models, such as peer-to-peer insurance and on-demand insurance, catering to emerging market segments and expanding revenue streams.

What is Blockchain Insurance Market Regional Insight?

The regional landscape of the blockchain insurance market shows varying levels of adoption and regulatory frameworks across different geographies. North America leads in adoption due to its strong focus on technological innovation and a robust regulatory environment that supports experimentation with blockchain in insurance applications. Europe follows closely, driven by initiatives to enhance transparency and efficiency in financial services, including insurance, through blockchain technology. In Asia-Pacific, particularly in countries like China and India, there is increasing interest in blockchain for insurance to address inefficiencies in traditional insurance processes and improve customer trust. Emerging markets in Latin America and Africa are also exploring blockchain’s potential to leapfrog legacy systems and provide accessible insurance solutions to underserved populations.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐚𝐧𝐝 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐮𝐫 𝐏𝐫𝐨𝐝𝐮𝐜𝐭’𝐬 𝐏𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥: https://www.maximizemarketresearch.com/request-sample/11489/

What is Blockchain Insurance Market Segmentation?

by Provider

Application and solution provider

Middleware provider

Infrastructure and protocols provider

by Application

GRC management

Death and claims management

Identity management and fraud detection

Payments

Smart contracts

Others (content storage management and customer communication)

by Organization Size

Small and Medium-sized Enterprises (SMEs)

Large enterprises

by Component

Solution

Service

Some of the current players in the Blockchain Insurance Market are:

North America:

1. Lemonade

2. MetLife

3. AXA XL

4. State Farm

5. Liberty Mutual

Europe:

1. B3i (Blockchain Insurance Industry Initiative)

2. Allianz

3. Generali

4. Mapfre

5. Swiss Re

Asia-Pacific:

1. Ping An Insurance

2. Bajaj Allianz General Insurance

3. Sompo Japan Nipponkoa Insurance

4. Tokio Marine & Nichido Fire Insurance

5. QBE Insurance

𝐆𝐞𝐭 𝐭𝐨 𝐊𝐧𝐨𝐰 𝐌𝐨𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐭𝐮𝐝𝐲: https://www.maximizemarketresearch.com/market-report/blockchain-insurance-market/11489/

Key Offerings:

Past Market Size and Competitive Landscape

Blockchain Insurance Market Size, Share, Size & Forecast by different segment

Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region

Blockchain Insurance Market Segmentation – A detailed analysis by Product

Competitive Landscape – Profiles of selected key players by region from a strategic perspective

Competitive landscape – Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER’s analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

For additional reports on related topics, visit our website:

♦ Wine cellar market: https://www.maximizemarketresearch.com/market-report/wine-cellar-market/78673/

♦ Beer Bottles Market: https://www.maximizemarketresearch.com/market-report/global-beer-bottles-market/54479/

♦ Global Static RAM Market: https://www.maximizemarketresearch.com/market-report/global-static-ram-market/115858/

♦ Global GPS Tracking Device Market: https://www.maximizemarketresearch.com/market-report/global-gps-tracking-device-market/55483/

♦ Vegetable Oil Market: https://www.maximizemarketresearch.com/market-report/global-vegetable-oil-market/108821/

♦ Medical Waste Management Market: https://www.maximizemarketresearch.com/market-report/global-medical-waste-management-market/21112/

♦ Nitrogenous Fertilizers Market: https://www.maximizemarketresearch.com/market-report/global-nitrogenous-fertilizers-market/97986/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Credit: Source link