Decentralized Finance Market

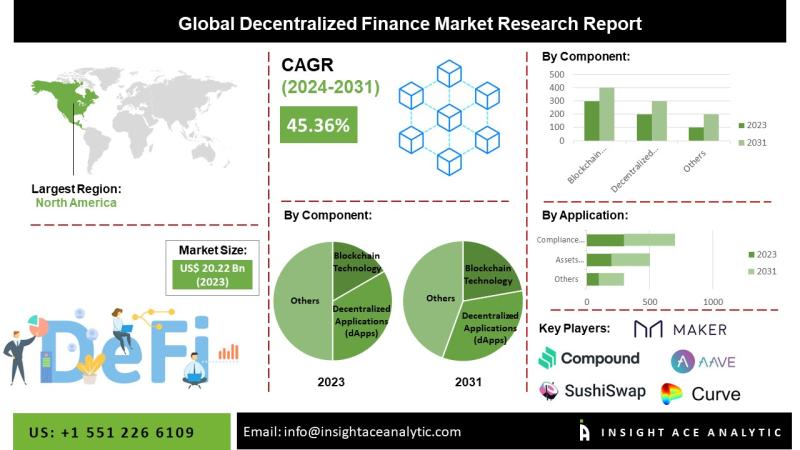

Decentralized Finance Market to reach over USD 398.77 billion by the year 2031 – Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Decentralized Finance Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction Industry, Stablecoins)- Market Outlook And Industry Analysis 2031”

The global decentralized finance market is estimated to reach over USD 398.77 billion by 2024- 2031, exhibiting a CAGR of 45.16% during the forecast period.

Request for free Sample Pages: https://www.insightaceanalytic.com/request-sample/1607

Decentralized Finance Platforms: Powering Growth in E-sports, Entertainment, and Beyond

Decentralized finance (DeFi) platforms have emerged as a key driver of innovation across various sectors. Their ability to boost efficiency through DeFi tokens used for in-app transactions has fueled growth. Notably, the surge in e-sports and entertainment has been a significant driver for DeFi platforms.

The potential for users to trade tokens and cultivate ecosystems on the blockchain has sparked interest in leveraging DeFi for marketing games and digital artifacts. For instance, platforms like Augur allow users to place bets on real-world events, fostering a more engaging experience. The advent of blockchain-based prediction systems powered by DeFi is expected to create further growth opportunities.

Furthermore, DeFi’s ability to eliminate intermediaries in financial transactions is driving its adoption. Traditional finance often suffers from cumbersome paperwork, verification processes, and complex structures. DeFi offers a streamlined alternative, particularly impacting the insurance industry.

However, the growth of DeFi is not without challenges. Security concerns remain a top priority, including risks of intentional hacking, user error, and vulnerabilities within DeFi networks. Addressing these challenges will be crucial for ensuring the long-term success of DeFi platforms.

List of Prominent Players in the Decentralized Finance Market:

• Curve Finance

• Synthetic

• Balancer

• Bancorp Network

• Badger DAO

• Compound Labs, Inc.

• Maker DAO

• Agave

• Unisa

• Sushi Swap

Market Dynamics:

Drivers-

The strong scalability, security, and enhanced functionality of the worldwide, decentralized finance business will drive its expansion throughout the forecast period. The market for decentralized finance (Decentralized finance) is anticipated to grow over the coming years as more people engage in the digital asset industry.

One of the main development drivers for the worldwide, decentralized finance (Decentralized finance) market is the sharp rise in e-sports activity. The benefits provided by Decentralized finance technology suppliers are fostering the sector’s expansion. The system abolishes the control that banks, and other financial institutions have on money, financial products, and financial services.

Challenges:

The key barriers to industry growth are user mistakes, deliberate hacking, and Decentralized finance network security. There are several risks associated with decentralized finance. First, smart contracts have an execution risk. This could result from coding mistakes made when creating smart financial contracts. Programming mistakes can lead to vulnerabilities that allow attackers to steal the money in a smart financial contract or render the code useless.

Regional Trends:

The North America decentralized finance market is expected to register a major market share in revenue and is projected to grow at a high CAGR soon. The supremacy is attributable to well-known competitors like Compounds and Unisa. Additionally, North America has one of the largest cryptocurrency markets in the world, which is positive for the uptake of Decentralized finance systems.

Besides, Asia Pacific had a substantial share of the market. This can be ascribed to Asia’s robust economic development and quick adoption of modern technologies. There are currently several examples of Decentralized finance platforms and other businesses using blockchain technology in the Asia Pacific.

Curious about this latest version of the report? @ https://www.insightaceanalytic.com/enquiry-before-buying/1607

Recent Developments:

• In January 2022.-A Web3 wallet company named Meta mask announced the beta launch of the Ethereum staking features that may be used with Lido’s liquid staking solutions According to reports, end users can select any staking provider from the Web3 wallet’s UI if they want to earn staking rewards. The project will support the worldwide decentralized finance (Decentralized finance) market’s growth.

• In January 2022-Blue, a company that provides identity verification services for Decentralized finance dealers, launched $3.2 million in investment in stealth mode. The tactical choice will be used to significantly enhance the Decentralized finance protocol’s identity verification operations.

Segmentation of Decentralized Finance Market-

By Component

• Blockchain Technology

• Decentralized Applications (daps)

• Smart Contracts

By Application

• Assets Tokenization

• Compliance & Identity

• Marketplaces & Liquidity

• Payments

• Data & Analytics

• Decentralized Exchanges

• Prediction Industry

• Stable coins

• Others

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

For More Customization @ https://www.insightaceanalytic.com/report/decentralized-finance-market/1607

Contact Us:

InsightAce Analytic Pvt. Ltd.

Tel.: +1 718 593 4405

Email: info@insightaceanalytic.com

Site Visit: www.insightaceanalytic.com

Follow Us on LinkedIn @ bit.ly/2tBXsgS

Follow Us On Facebook @ bit.ly/2H9jnDZ

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions.

Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses.

We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products.

Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

This release was published on openPR.

Credit: Source link