Bitstamp, a leading cryptocurrency exchange, is preparing for the imminent full enforcement of Europe’s Markets in Crypto-Assets Regulation (MiCA) by announcing its decision to delist the Euro Tether (EURT), a stablecoin pegged to the euro.

This strategic move comes ahead of the MiCA regulation taking effect on June 30, underscoring Bitstamp’s commitment to full compliance with emerging European regulations.

The History and Decline of Euro Tether

Introduced to the market in November 2021, the Euro Tether was one of the initial euro-denominated stablecoins available on Bitstamp.

Despite its early adoption, EURT has seen a drastic decrease in market capitalization over the past years, plunging from a high of approximately $236 million in February 2022 to a current valuation of around $33 million, as per data from CoinGecko.

This decline in valuation is notable given that Tether, the issuer of EURT, also operates the USD Tether (USDT), which remains the largest stablecoin by market value, boasting over $110 billion.

James Sullivan, Bitstamp’s managing director for the United Kingdom, elaborated on the exchange’s proactive approach towards MiCA compliance.

He stated that Bitstamp has consistently advocated for a balanced regulatory response that both safeguards consumers and promotes the ongoing development of cryptocurrencies as a viable asset class.

Sullivan emphasized that Bitstamp’s strong foundation in compliance and security positions it well to adapt to the regulatory changes positively, ensuring minimal disruption to its customers.

He noted that the delisting of EURT would directly affect only a small percentage of their clientele, whose asset portfolios include the euro-pegged stablecoin.

Handling Other Electronic Money Tokens (EMTs)

In addition to addressing the EURT delisting, Bitstamp has provided clarity on its handling of other Electronic Money Tokens (EMTs) not denominated in euros.

These EMTs, which are already trading on the platform but do not fall under the MiCA regulation, will continue to be available, albeit with some usage restrictions specific to European customers.

Bitstamp also declared that it would neither list any new EMTs that do not meet the MiCA standards nor engage in any promotional activities for such tokens.

Contrastingly, other cryptocurrency exchanges have adopted more extensive measures in response to the MiCA regulation. For instance, Uphold, another exchange platform, chose to delist USDT along with six other stablecoins earlier on June 18, aligning its operations with the new regulatory framework.

In addition, Tether’s CEO, Paolo Ardoino, has publicly criticized the European regulation, indicating in May that the company had no intention of conforming to the MiCA guidelines.

Binance’s Adjustments for Compliance

Meanwhile, Binance, another titan in the cryptocurrency exchange arena, is also making adjustments to ensure compliance with MiCA.

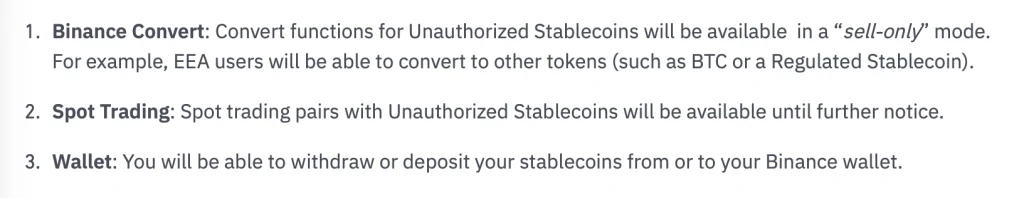

The exchange has begun notifying its users in the European Economic Area about upcoming changes to their service, specifically the categorization of stablecoins into “regulated” and “unauthorized” based on their adherence to the new rules.

Binance aims to smoothly transition its users from unauthorized to regulated stablecoins, as it anticipates a growing list of MiCA-compliant stablecoins entering the market.

Binance plans to employ a “sell-only” strategy for unauthorized stablecoins through its Binance Convert function, a move designed to phase out non-compliant tokens gradually.

As of now, only a select few stablecoins meet the requirements set forth by MiCA, but Binance is prepared to navigate this regulatory landscape by facilitating user transitions to compliant stablecoins.

These proactive adjustments by major exchanges like Bitstamp and Binance underscore the significant shifts within the cryptocurrency market as operators align themselves with new regulatory landscapes.

Their efforts are aimed at fostering a safer and more standardized environment for crypto asset trading across Europe, reflecting a broader movement within the financial technology sector to embrace regulatory changes that promise to enhance consumer protection and market stability.

Credit: Source link