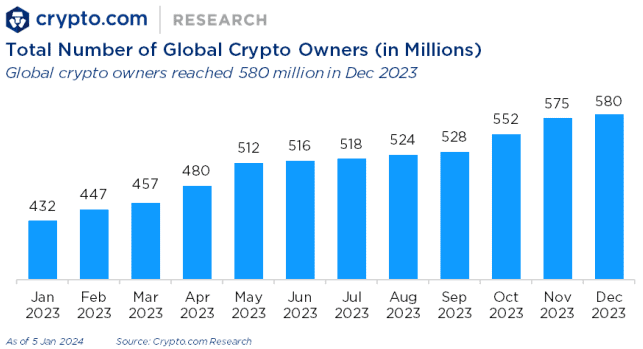

A new report from cryptocurrency exchange Crypto.com finds global ownership of digital assets grew by 34% in 2023. The user base grew from 432 million in January to 580 million by year’s end, despite economic volatility.

Bitcoin (BTC) and Ethereum (ETH) powered overall gains as the top cryptocurrencies by market capitalization.

Key adoption metrics:

- Bitcoin owners rose 33% to 296 million.

- Ethereum owners grew by 39% to 124 million.

- BTC and ETH accounted for 51% and 21% of all crypto owners, respectively.

Read more: Cryptocurrency Scam Defrauds Over 42,000 Victims Of $32 Million

The report cites pro-crypto developments in 2023 like the Ethereum Shanghai upgrade and emerging Bitcoin protocols for non-fungible tokens (NFT) minting as catalysts behind growth even amidst macro uncertainty.

Institutional Crypto Interest Expanded in 2023

According to the report, institutional interest also expanded, as evidenced by asset manager BlackRock, among others, filing for Bitcoin ETFs.

Bitcoin saw exceptional spikes in April and May, alongside Ethereum’s major network upgrade event, which enabled staking and other anticipated features. ETH equally benefited from Bitcoin’s progress with NFTs and tokenization.

“Bitcoin and Ethereum mutually led the adoption growth in 2023.” “The newly introduced Bitcoin NFT and BRC-20 token standard derived from the Ordinals protocol drove strong demand for Bitcoin’s block space,” the report states.

Read more: Crypto Pyramid Scheme: German CEO Charged With $150 Million Fraud

While optimistic about expansion in global ownership, the exchange acknowledges crypto metrics still have limitations, including:

- Difficulty capturing off-chain crypto activity.

- Assumptions: all on-chain users still own assets.

- Sampling biases from internal surveys.

Nonetheless, with high-profile backers like BlackRock moving into crypto, regulatory frameworks progressing, and new use cases like NFTs emerging across blockchains, the report foresees tailwinds for broader adoption once macro conditions stabilize.

Credit: Source link