Following the significant increase in premium volumes of 9.1% in 2021, due to a strong recovery from the Covid-19 pandemic, the global long-term (life) insurance industry contracted by 3.1% in 2022, based on the erosion of consumer savings and nominal premium growth during the year.

However, positively, the industry is set to return to growth of an estimated 1.4% in 2024, with one of the key drivers of this growth being digital transformation, including a move to mobile app-based offerings, and even an expansion into the metaverse. This is enabling the industry to connect with the next generation of consumers, as well as offer enhanced convenience, transparency, and next-level customer experience.

Insight Survey’s latest South African Long-Term Insurance Industry Landscape Report 2024 carefully uncovers the global and local long-term insurance market, based on the latest information and research. It describes the key global and local market trends, innovation and technology, drivers, and challenges, to present an objective insight into the South African long-term insurance industry and its future.

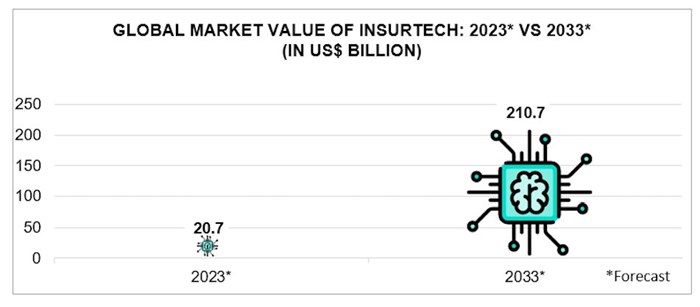

In 2023, the InsurTech market was expected to continue to expand rapidly, with a predicted compound annual growth rate of 26.1%, to reach a total value of $210.7bn in 2033. This expansion can be largely attributed to rapidly growing demand from a wider range of consumers for InsurTech offerings, as well as ongoing technological developments in the industry. This includes the increased use of internet of things (IoT) devices, and the use of artificial intelligence to combat fraud, as well as the leveraging of partnerships with traditional companies for wider distribution and customer bases.

Globally, there continues to be a rise in a digital-first approach to life insurance products and services amongst players, due to increased demand for convenience, simplicity, transparency, and user-friendliness amongst consumers. This is the resulting in the emergence of a large number of digital life insurance platforms, including mobile applications and digital customer experiences that make life insurance more interesting and appealing. With this, there has been a rapid emergence of innovative trends and products focusing on consumer simplicity and accessibility, particularly amongst younger consumers, including millennials and Gen-Z.

As an example of this globally, Choice Mutual, the largest digital marketplace for final expense insurance products, announced the launch of its mobile app, which assists seniors in avoiding scams when shopping for final expense life insurance. In terms of the foray into virtual reality and social media, SBI Life Insurance launched its LifeVerse Studio in the metaverse, to connect with the next wave of young internet users and revolutionise consumer experience in an immersive virtual world.

Locally, Sanlam launched its ‘LI:FE of Confidence’ campaign, South Africa’s first-ever media launch to be held in the metaverse. This campaign aimed to educate local consumers on the concepts of compound interest, retirement savings and life insurance by realistically visualising how their financial lives will develop over time.

Consumer demands for convenient, flexible, and transparent life insurance are also resulting in the introduction of a large number of mobile app-based offerings, that make it easy for a wide range of consumers to obtain and manage life insurance products. These mobile apps also have a focus on offering customisability, whilst also benefiting players in terms leveraging additional customer data.

As an example, as part of its launch into the South African market, the UK-based based InsurTech, YuLife, also introduced its well-being app, which enables employees to complete everyday wellness activities to earn YuCoin, YuLife’s virtual wellbeing currency. This currency can then be used to purchase vouchers for groceries, fuel, and data, amongst others, or donated to charitable causes, such as donating meals, planting trees, or cleaning the ocean.

Furthermore, major local player, Momentum, recently announced that the company will add more features to its in-app digital life insurance screening tool, LifeReturns. This includes the incorporation of a mobile fitness assessment tool to make the entire screening process enabled by mobile technology.

Additionally, MTN South Africa also recently announced that the company was introducing a cost-effective funeral cover offering under its new Khava brand. The new offering, which is backed by Sanlam and facilitated by aYo Intermediaries South Africa, will utilise the WhatsApp platform for its onboarding process, with collections and claims payments being made through MTN’s Mobile Money (MoMo) platform.

The South African Long-Term Insurance Industry Landscape Report 2024 (140 pages) provides a dynamic synthesis of industry research, examining the local and global long-term insurance industry from a uniquely holistic perspective, with detailed insights into the entire value chain – from market size, industry trends, latest innovation and technology, key drivers and challenges, to a detailed competitor and product analysis.

Some key questions the report will help you to answer:

- What are the current market dynamics (overview, market environment, and key regional markets) in the global long-term insurance industry?

- What are the latest news and developments in the South African long-term insurance industry, as well as the current market dynamics (overview, market environment, and key industry statistics)?

- What are the latest global and South African long-term insurance industry trends (including Insurtech), innovation and technology, drivers and challenges?

- How did South African long-term insurance companies perform in 2023?

- What is the latest company news for each South African long-term insurance player, in terms of products, services, new launches, and marketing initiatives?

- What is the latest marketing and advertising news for each of the key long-term insurance players?

Please note that the 140-page report is available for purchase for R47,500 (excluding VAT). Alternatively, individual sections can be purchased from R20,000 (excluding VAT).

For more information, please email az.oc.yevrusthgisni@ofni or call our Cape Town office on (021) 045-0202 or Johannesburg office on (010) 140- 5756.

For more details and a full brochure: South African Long-Term Insurance Industry Landscape Report 2024.

Credit: Source link