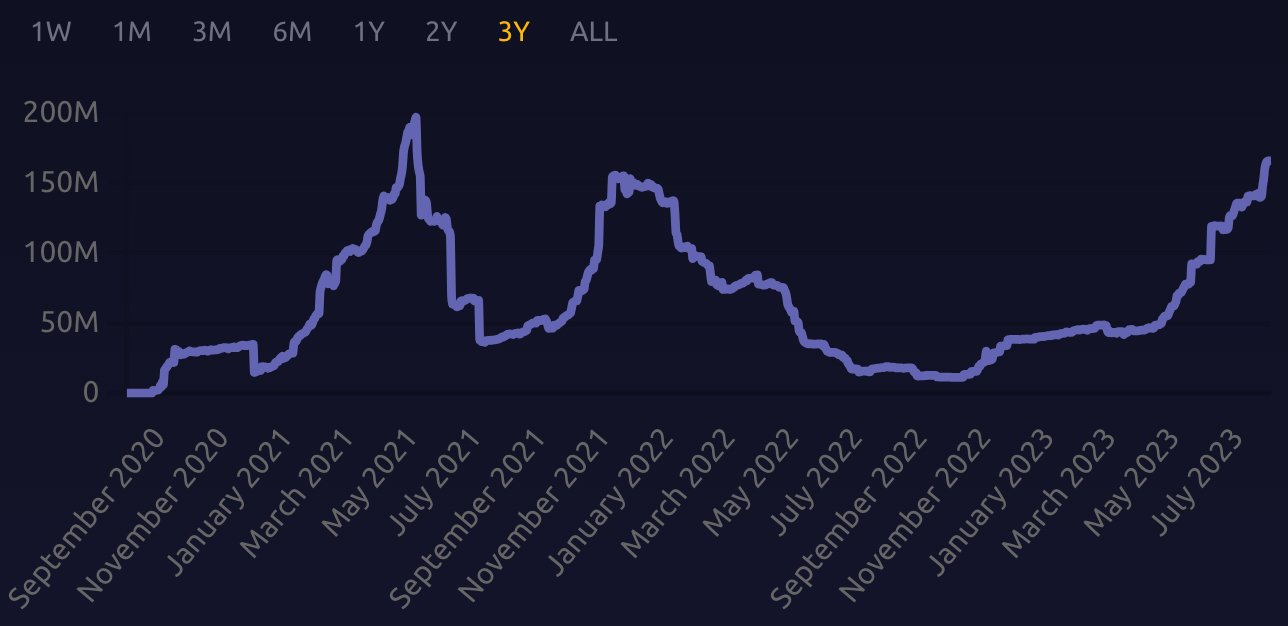

The annualized revenue generated by the popular decentralized finance (DeFi) protocol Maker has risen to over $165 million, representing a 2-year high.

The strong development in revenue could be seen in data from Makerburn.com, which at the time of writing also showed that revenue had surpassed the high from November 2021 to reach its highest since May of 2021.

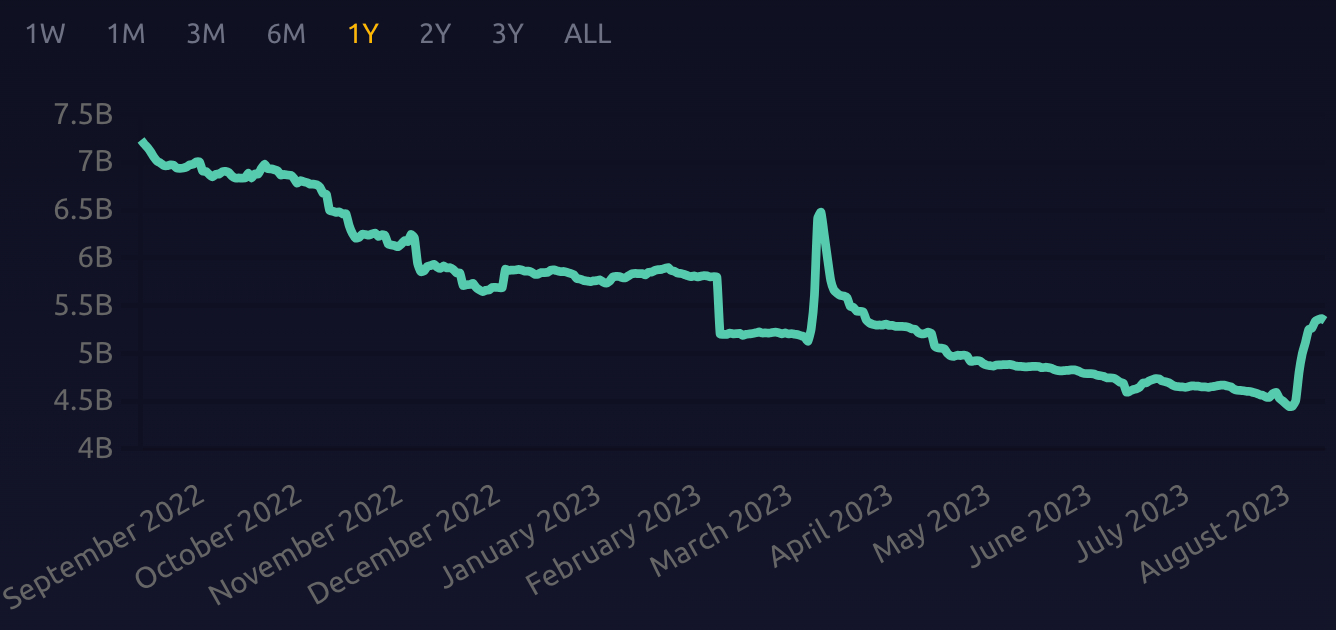

Meanwhile, the supply of DAI, the US dollar-pegged stablecoin issued by MakerDAO, rose to a 5-month high of 5.35 billion DAI, data from the same website showed.

The rise comes as more users, including high-profile crypto personalities like Tron founder Justin Sun, have bought DAI to take advantage of a higher interest rate on deposits that is paid out by the Maker protocol.

The increased deposit rate, now at 8% annually, was approved by the Maker community on August 4, with Maker founder Rune Christensen announcing the change to his followers two days later.

“The rate is so high is because there are currently not that many people using the Dai Savings Rate – only about 8% of Dai holders use [Dai Savings Rate – DSR] currently. This causes the Enhanced DSR system to increase the rate to attract more users. Once more users arrive, the rate will go back down,” the Maker founder commented at the time.

Maker’s Dai Savings Rate contracts allow holders of DAI to earn a share of the protocol’s revenue by depositing DAI.

Revenue is generated both from yields on collateral deposits and fees paid by users of the protocol.

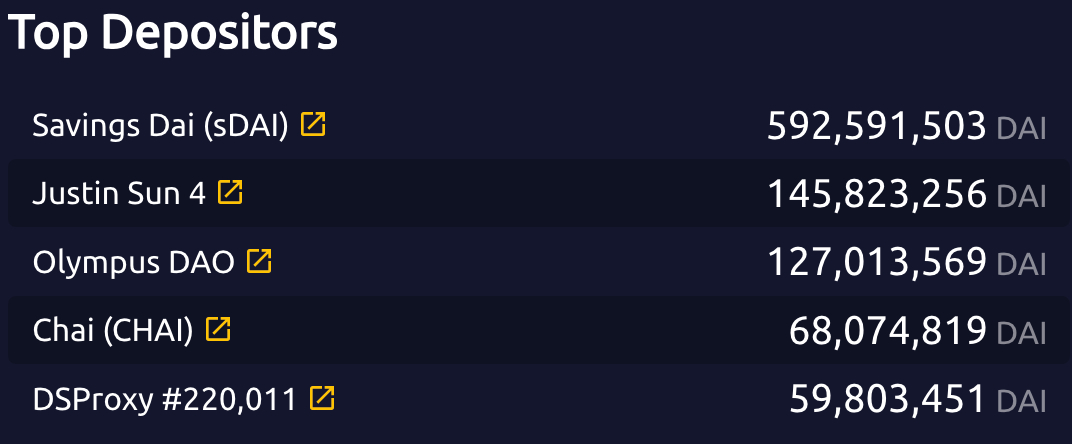

According to Makerburn.com’s Top Depositors ranking, Justin Sun and wallets associated with the decentralized stablecoin protocol OlympusDAO have deposited $148.5 million and $124.8 million worth of DAI, respectively, to take advantage of the increased interest rate.

Credit: Source link