Bitcoin’s price has drawn renewed attention following the activation of a historically reliable on-chain signal—the Hash Ribbon indicator. Currently trading around $84,500 after a 3.9% drop over the past 24 hours, Bitcoin (BTC) is under pressure from broader macro uncertainty.

However, the Hash Ribbon, which measures miner stress and recovery using 30-day and 60-day hash rate moving averages, has now flashed its eighth major buy signal in BTC’s history.

Developed by Charles Edwards, this signal occurs when the 30-day MA crosses above the 60-day MA, suggesting miner capitulation has ended. Historically, BTC has never dropped lower in 85% of previous cases following this signal.

Market commentators, including Bitcoin Archive, emphasize that in all seven prior instances, BTC rallied significantly post-signal, with no false triggers.

- BTC is down 3.9% over 24 hours, trading at $84.5K

- Hash Ribbon signal appeared only 20 times in BTC’s history

- Historically accurate in 85% of cases, signaling limited downside

Mixed Market Signals: A Warning from the Charts

Despite the optimism, technical analysts remain divided. Tony Severino, a Chartered Market Technician, flagged bearish divergences between price action and momentum indicators. “BTC is making higher highs while the RSI posts lower highs. That’s not bullish—it’s a red flag,” he noted.

BTC remains below the 50-period EMA near $86,000, reinforcing short-term bearish structure. The RSI sits around 36, rebounding from oversold levels, but lacks momentum. Unless BTC breaks above $86,800, recovery remains uncertain.

Macroeconomic Headwinds Add Caution

Even with the bullish on-chain signal, macro forces loom large. Strong U.S. economic data—Q4 GDP revised to 3.4% and jobless claims declining—supports a hawkish Fed stance, dampening appetite for risk assets like Bitcoin.

Meanwhile, geopolitical tensions are flaring again with Trump’s proposed 25% auto tariffs, set for April 2. While gold surged to an all-time high of $3,059 on the news, BTC hasn’t mirrored the safe-haven rally.

This divergence has left some questioning Bitcoin’s role as digital gold. Jamie Coutts of Real Vision noted, “Hash Ribbons are a solid signal, but broader conditions aren’t aligning like previous cycles.”

With Wall Street returning post-holiday and ETF flows stabilizing, short-term direction may depend on how BTC reacts to upcoming inflation data.

- Gold hits $3,059 ATH while BTC lags behind

- Trump’s tariffs add to global economic anxiety

- ETF inflows flatline amid mixed crypto sentiment

Bitcoin Consolidates Near $84.5K Amid Cooling Bearish Pressure

BTC is stabilizing near $84,500 after a sharp drop, finding short-term support at $83,000. The RSI is rebounding from oversold levels, hinting at fading bearish momentum.

However, BTC remains below the 50-EMA at $86,000, keeping the near-term bias bearish.

- Upside target: Break above $86,800 could trigger a rally toward $88,800

- Downside risk: Drop below $83,000 may expose $81,200

- Market tone: Cautious, with $34B daily volume and 2.86% drop

BTC is consolidating in a narrowing range, with macro catalysts likely to dictate the next move.

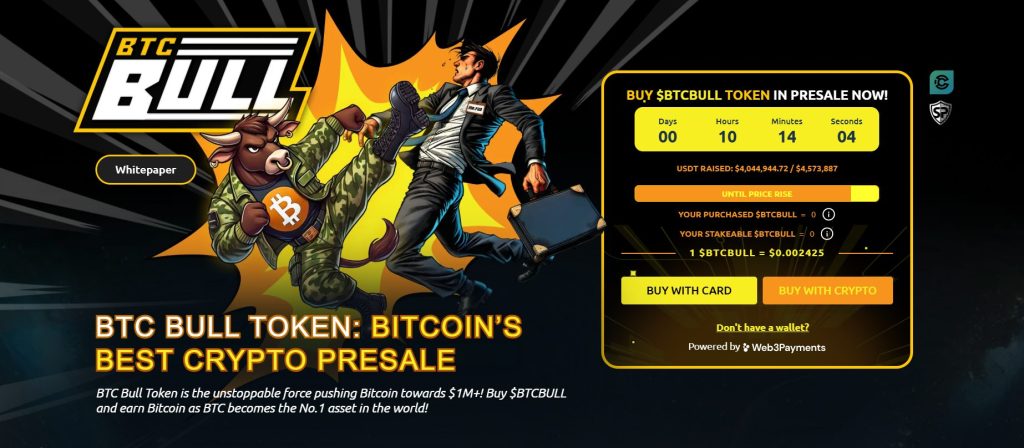

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that automatically rewards holders with real Bitcoin when BTC hits key price milestones. Unlike traditional meme tokens, BTCBULL is built for long-term investors, offering real incentives through airdropped BTC rewards and staking opportunities.

Staking & Passive Income Opportunities

BTC Bull offers a high-yield staking program with an impressive 119% APY, allowing users to generate passive income. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting strong community participation.

Latest Presale Updates:

- Current Presale Price: $0.002425 per BTCBULL

- Total Raised: $4M / $4.5M target

With demand surging, this presale provides an opportunity to acquire BTCBULL at early-stage pricing before the next price increase.

The post Is This BTC’s Bottom? One of the Most Trusted Buy Signals in Bitcoin Just Flashed appeared first on Cryptonews.

Credit: Source link

(@el_crypto_prof)

(@el_crypto_prof)