On May 13, The President of the United States, Joe Biden, issued a directive prohibiting MineOne from acquiring real estate near a strategic missile base. The US government found that MineOne, mainly owned by Chinese nationals, aimed to use the property for crypto mining.

This decision stems from national security concerns due to the site’s proximity to Francis E. Warren Air Force Base. The base hosts Minuteman III intercontinental ballistic missiles.

National Security Concerns Prompt Presidential Action

The Committee on Foreign Investment in the United States (CFIUS) saw risks in the foreign-owned, specialized equipment at the site.

“The proximity of the foreign-owned Real Estate to a strategic missile base and key element of America’s nuclear triad, and the presence of specialized and foreign-sourced equipment potentially capable of facilitating surveillance and espionage activities, presents a national security risk to the United States,” the President’s order reads.

As a result of these findings, the transaction has been prohibited. MineOne and its affiliates must sell or transfer all ownership interests in the property within 120 days. Additionally, they must remove all equipment and improvements from the site within 90 days and certify the completion of these actions.

Read more: How To Build a Mining Rig: A Step-by-Step Guide

MineOne and its affiliates are restricted from accessing the property throughout this period and must ensure compliance with the order. They must also provide weekly updates to CFIUS until all conditions are met.

The Department of Treasury issued an official statement following the President’s order. In the statement, Secretary of the Treasury Janet L. Yellen emphasized that this order shows President Biden’s commitment to protecting national security.

“It also highlights the critical gatekeeper role that CFIUS serves to ensure that foreign investment does not undermine our national security, particularly as it relates to transactions that present risk to sensitive US military installations as well as those involving specialized equipment and technologies,” Secretary Yellen added.

Furthermore, Assistant Secretary of the Treasury for Investment Security Paul Rosen reiterated that CFIUS expects complete, accurate, and timely information from involved parties. He also stressed that failure to address national security risks would prompt decisive actions, including Presidential interventions.

This order follows the Department of the Treasury’s proposed 30% tax on electricity consumption by crypto mining firms as part of the Fiscal Year 2025 Revenue Proposals. This proposal aims to mitigate the environmental impact of the crypto mining industry’s rising energy demand.

Under this scheme, crypto mining firms must report the quantity and cost of electricity consumed, including off-grid power production. The tax will be introduced gradually, starting at 10% and reaching 30% by the third year, effective January 1, 2025.

Biden’s Crypto Policies Stir Controversy and Industry Reaction

The Biden administration’s tougher stance towards the crypto industry is further evidenced by its position on H.J. Res 109, a resolution to nullify the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin (SAB) 121. This bulletin requires financial institutions to include customers’ digital assets on their balance sheets, which the crypto community sees as burdensome.

The White House has clarified that rejecting this rule would weaken the SEC’s investor and financial system protections. President Biden is ready to veto the resolution.

In response to the current regulatory environment, industry players are rallying to support pro-crypto political candidates. Coinbase has created a new political action committee (PAC) named “Stand With Crypto” to support crypto-friendly candidates financially.

Coinbase’s PAC has garnered support from various parties, including Moonpay, a fintech platform that supports crypto transactions. Moonpay CEO Ivan Soto-Wright emphasized the importance of advancing crypto innovation.

“This year’s election will define the future of our industry in the United States, and it is our responsibility to step up and stand alongside those organizations that want to positively advance crypto innovation for everyone,” Soto-Wright stated.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

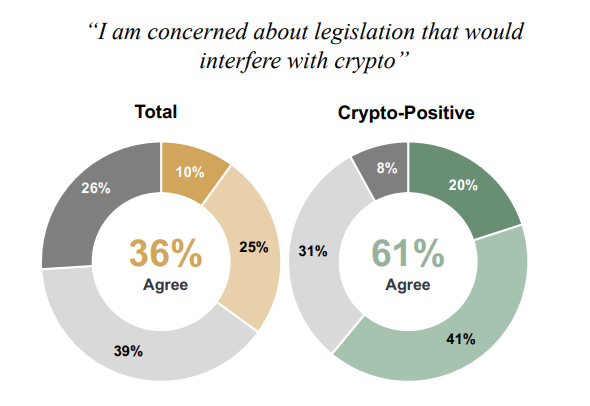

Also, prominent crypto community figures, such as Mark Cuban and Hayden Adams, have warned that Biden’s current stance could impact the upcoming elections. The warning aligns with a recent report from the Blockchain Association. The report indicates that one in five US voters considers crypto a key issue, with many distrusting candidates who interfere with crypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Credit: Source link