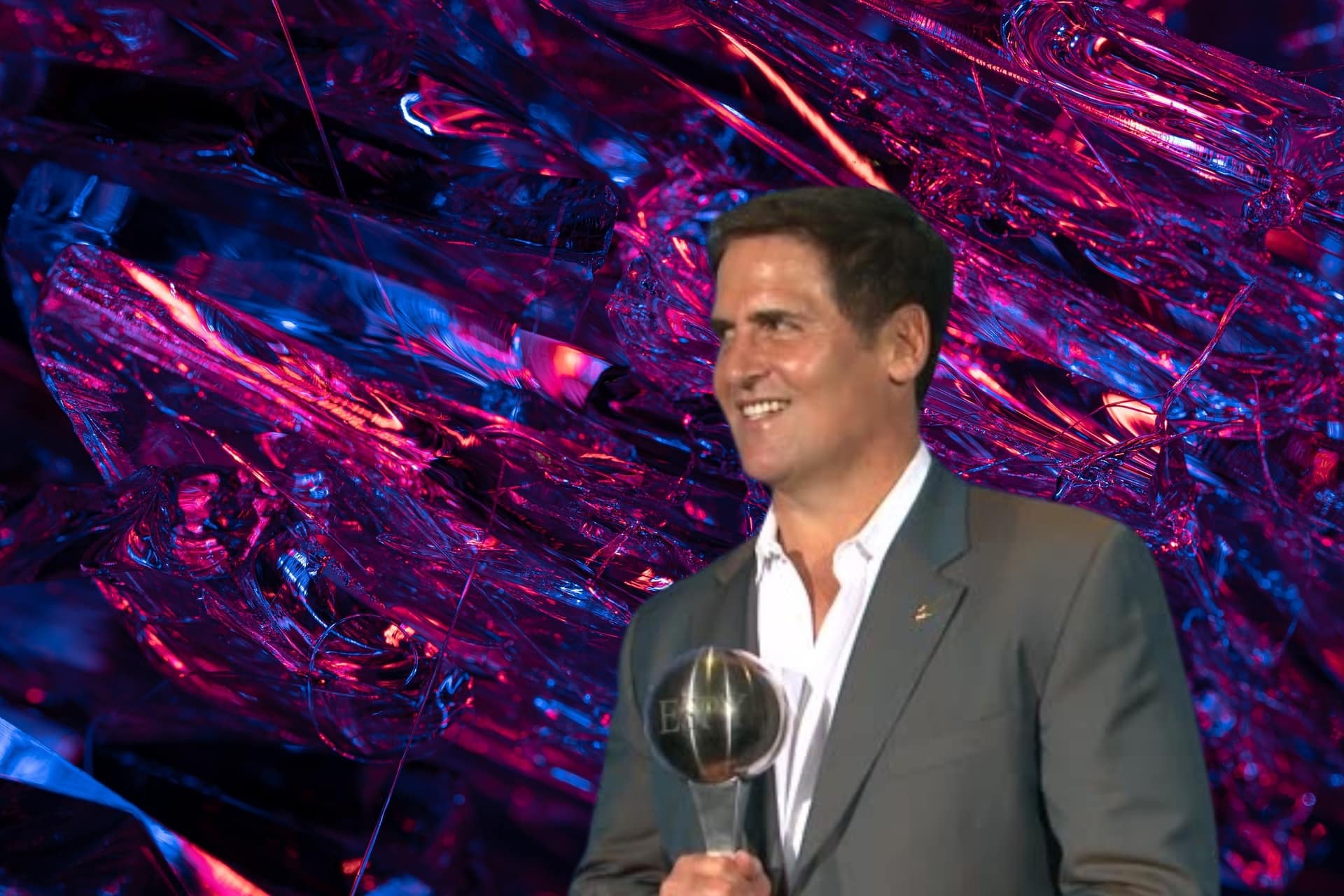

Mark Cuban has hit out against the Securities and Exchange Commission (SEC) efforts towards regulating US crypto industry, and in a twist, the millionaire crypto investor has spotlighted Japan cryptocurrency regulation as the perfect regulatory example.

Lauding Japan’s clarity and effectiveness in the cryptocurrency regulatory environment, American billionaire and entrepreneur Mark Cuban expressed his concern over the US SEC approach to crypto regulation.

Aiming at the current Biden administration, Cuban called for a significant overhaul in how the US handles its regulatory framework for digital assets.

Dear @SenateDems , @HouseDemocrats can we please learn from what Japan is doing ? Why is it they are fully supporting it, and our SEC is making it impossible to survive in the USA ?

This is the first technology that I can recall that we have handed to the rest of the world,… https://t.co/R0EaHu4fTp

— Mark Cuban (@mcuban) May 12, 2024

In an outburst that has caught the attention of the crypto community and regulators alike, Cuban has taken to Twitter (Now X) to criticize SEC’s reactive measures, especially following the collapse of FTX.

Meanwhile, he has praised Japan’s proactively implemented regulatory measures, which protect investors and encourage innovation.

Cuban’s Criticism of SEC Latest In Series of Criticisms For Gensler’s Commission

Cuban goes on to argue that the SEC’s failures have not been limited to the digital assets space, citing instances of fraud and institutional lapses such as the Madoff scandal and the FTX incident.

If the sec has taken the same approach as Japan , there would not have been an ftx issue. Japan FTX didn’t have losses, because they actually learned and put together an approach that put investors first and personal political gain didn’t come into play

— Mark Cuban (@mcuban) May 11, 2024

Criticizing the SEC and SEC Chair Gary Gensler, Cuban said, “They make it impossible to comply with registration rules, since the SEC decided to litigate to regulate rather than make any effort to increase compliance. If I get an investment opportunity that is going to release a token, it’s now a no from me. Not because of the company itself, rather because the SEC will not allow it to operate. The cost in time and legal fees to attempt to register and comply make it impossible to realistically operate.”

“The crypto industry wants a way to register and comply,” added Cuban.

“It wants a way to keep the speculative noise out. Instead the SEC makes it so expensive, time consuming and difficult for those who want to comply, that the junk tokens are side by side with real companies and investors have no way to know what is garbage and what is real.”

This is not the first time Cuban has openly criticized the SEC. He has taken to public platforms multiple times to express his discontent with the SEC’s actions and the lack of regulatory clarity.

Back in 2022, Cuban openly criticized Gensler. Responding to Gensler’s op-ed in the Wall Street Journal, Cuban had tweeted, “ Since you understand crypto lending/finances, why don’t you just publish bright line guidelines you would like to see and open it up for comments?”

EXPLORE: 10 Best No KYC Crypto Casinos For 2024

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Credit: Source link