filo/iStock via Getty Images

Meta (NASDAQ:META) owns Facebook, Instagram, Messenger, WhatsApp, and the Oculus platform and products. Currently, 97% of their total revenue comes from the digital advertising business. It appears that their core business is experiencing slowing growth due to a saturated user base and significant competition from TikTok. Moreover, Meta is making substantial investments in the Metaverse, but the outcome of these endeavors remains highly uncertain.

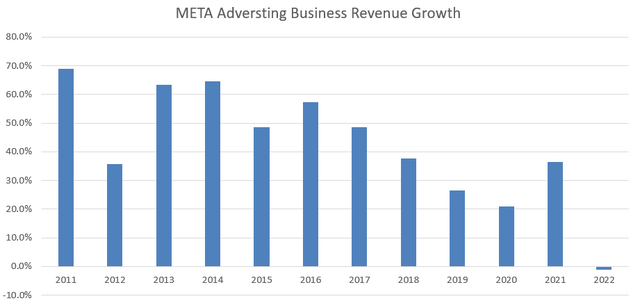

Ads Business Deceleration

Advertising remains Meta’s core business, accounting for approximately 97% of the company’s total revenue. In recent years, Meta’s advertising business has been experiencing a slowdown.

Meta 10Ks

I believe that TikTok is the primary factor contributing to the deceleration of Meta’s advertising business. In March 2023, TikTok announced it had reached 150 million monthly active users in the United States. Notably, TikTok had only 100 million MAU as of August 2020.

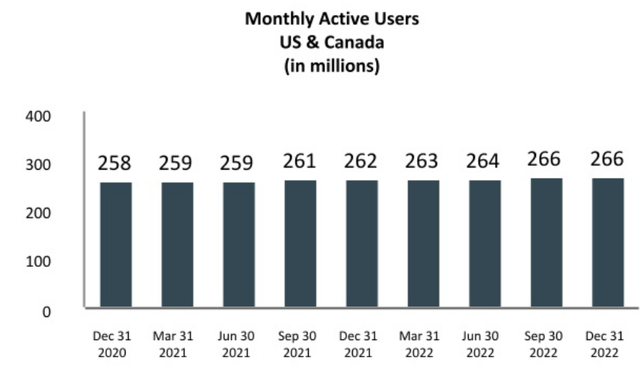

In comparison, the number of Facebook Monthly Active Users has shown limited growth since 2020, with only an 8 million increase in the US & Canada from December 2020 to December 2022. It’s evident that TikTok has been gaining a significant share of the market from Facebook over this period.

Meta 2022 Annual Report

TikTok’s success can be attributed to its highly advanced algorithm—a recommendation system that determines which videos appear to users. This algorithm learns a user’s preferences based on the videos they watch and engage with, subsequently curating a personalized video feed for each user. This personalized experience makes it easy for users to become engrossed in the platform. The more videos a user watches, the more refined and accurate the algorithm becomes.

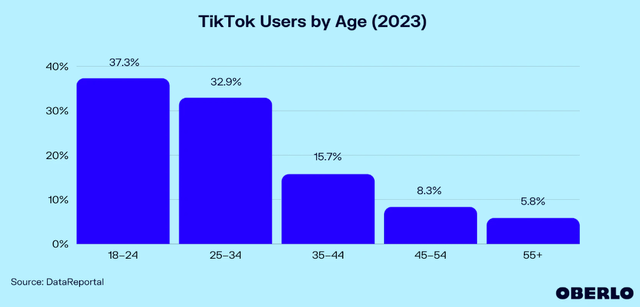

Furthermore, TikTok has consistently appealed to the younger generation. According to Oberlo research, a significant majority of TikTok users fall within the 18-34 age range. This youthful user base places TikTok in a strong competitive position against Facebook and other social media platforms.

Oberlo Research

Massive Bets on Metaverse

Meta’s Reality Labs business generated only $2.1 billion in revenue but incurred a loss of over $13 billion in FY22. The revenue of Reality Labs primarily comes from consumer hardware products, including the Meta Quest and wearables.

Meta is placing a significant bet on the Metaverse and is set to launch the Quest 3 Mixed Reality headset soon. According to their disclosure, the 128GB headset will start at $499.99. It’s worth noting that this mixed reality headset is among the most affordable options on the market. However, several major technology companies are also entering the mixed reality space. For instance, Apple (AAPL) has announced its mixed reality headset, Vision Pro, with a starting price of $3,499.

Beyond headsets and video games, Meta’s Metaverse includes Horizon Worlds. Meta envisions that their hardware and software will provide a mixed reality experience that combines the real and virtual worlds. Personally, I’m unsure about the key benefits of living in a mixed reality world, aside from online gaming. It’s not clear to me why I would want to wear a mixed reality headset or glasses to conduct virtual and real meetings in a meeting room with colleagues.

In summary, I believe Meta’s core business is likely to experience slowing growth in the coming years, and Mark Zuckerberg must explore other growth avenues for the company’s future. The outcome of Meta’s Metaverse venture remains uncertain to me. While Meta might create an excellent gaming platform for mixed reality games, I don’t believe it will be sufficient to offset any slowdown in their core business.

In Q2 FY23, Meta guided that Reality Labs’ operating losses are expected to increase year-over-year in 2023. It doesn’t seem likely that they will start generating operating profits from this business anytime soon.

Corporate Restructuring

Meta laid off more than 11,000 employees in 2022 and cut an additional 10,000 jobs in Q2 2023, reducing their workforce to over 71,400 employees by the end of the second quarter. This represents a 7% decrease from the first quarter. The decision to undertake massive layoffs seems reasonable given their stagnant top-line growth; it’s a necessary cost management measure.

As disclosed in their Q2 FY23 earnings call, Meta anticipates incurring approximately $4 billion in restructuring costs related to severance and other personnel expenses for the full fiscal year of FY23. I believe Meta’s corporate restructuring efforts will likely continue in the near future. The lack of a clear vision for their Metaverse strategy, combined with ongoing financial losses, may lead to increased resistance from shareholders.

Financials and Outlook

In Q2 FY23, their topline grew by 11% year-over-year, and operating profits increased by 12%. Family daily active users increased by 7% year-over-year, while Facebook monthly active users only grew by 3% compared to Q2 FY22.

Their balance sheet appears robust, with $53.45 billion in cash and cash equivalents and $18.38 billion in debt. They also repurchased $793 million worth of Class A common stock in Q2 FY23, with $40.91 billion still authorized for repurchases. Regarding the full year guidance, they expect $27-30 billion in capital expenditure, and guide increasing capital spending in FY24 as they have to increase investment in AI related data centers and servers. In addition, they expect Reality Labs’s operating loss to increase year over year. My biggest takeaway from the quarter is they have to make more investment in the near future to turnaround their growth, and more losses should be expected by investors.

Risks To Consider

In addition to the issues we’ve discussed earlier, one of the near-term risks that Meta faces is the impact of a weak macroeconomic environment. Many enterprises are currently focused on cost management and budget cuts in anticipation of a potential economic recession. Digital advertising spending is often considered discretionary, making it more likely that enterprises will reduce their advertising budgets during economic downturns.

The possibility of reduced advertising spending could pose significant challenges for Meta. The company’s management team has already noted sizable fluctuations in advertiser demand throughout 2022, indicating a period of volatility. Looking ahead, they anticipate a wide range of possible outcomes for advertiser demand.

Valuation

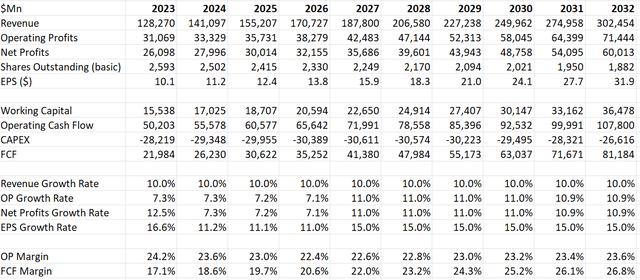

In my model, I’ve assumed that Meta’s growth rate will remain at 10% over the next decade. However, due to significant investments in AI and the Metaverse, I anticipate a decline in their operating margin from FY23 to FY26, followed by a gradual recovery starting in FY27. By FY32, I project their operating margin to reach 23.6%, with a corresponding expansion in free cash flow margin to 26.8%.

Meta DCF – Author’s Calculation

In my model, I’ve applied a 16% tax rate, a 10% discount rate, and a 4% terminal growth rate. I forecast that Meta will continue to repurchase their own shares, resulting in a reduction in the total shares outstanding over the next decade. By discounting all the free cash flows from the firm and adding back net cash, I estimate the fair value of Meta’s stock price to be $250 per share.

Closing Remarks

I believe Meta’s core advertising business is encountering formidable competition and is grappling with growth challenges. The outcome of their early investments in the Metaverse remains uncertain, and their new ventures are expected to incur losses, potentially leading to investor resistance in the future. Taking into account these factors and the current valuation, I recommend a ‘Sell’ rating for Meta.

Credit: Source link