Bitcoin is surging — currently up more than 40% since the Securities and Exchange Committee approved 11 spot market ETFs on January 10.

In fact, Monday’s midday price around $67,000 is just a few percentage points shy of bitcoin’s all-time high reached back in late 2021 (It may be even closer as you read this article).

But the cryptocurrency market certainly doesn’t feel the same as it did in 2021, does it?

Back in 2021, crypto was everywhere.

New alternative coins (altcoins) were popping out of the woodwork on an almost daily basis.

Crypto aficionados were obsessed with the seemingly endless investing possibilities, from staking and yield farming to decentralized finance (DeFi).

New crypto-based assets like NFTs also caught on like wildfire — reaching a fever pitch when Christie’s held its first-ever digital art auction, selling a single NFT for $69 million in March of 2021. Sotheby’s brought in $26 million with its own “Bored Ape” NFT auction.

Fast forward to today, and most of those altcoins have crashed to near-zero value…

Sam Bankman Fried’s high-yield FTX offerings ultimately turned into a $16 billion bankruptcy…

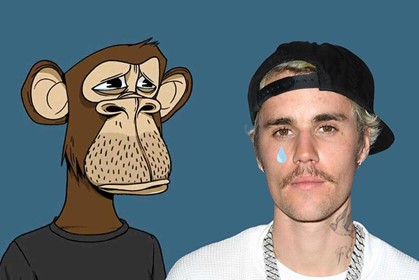

And the value of NFTs has likewise imploded. Pop singer Justin Bieber famously spent $1.3 million on a single Bored Ape, only to watch its value sink to just $59,090 in a little over a year.

Justin Bieber’s Bored Ape NFT Investment Ends in Tears

Early adopters quickly learned their lesson after seeing substantial losses on “bubble-era” investments like NFTs.

But even then, mainstream cryptocurrencies like bitcoin and ethereum still aren’t receiving the kind of attention they were getting just two years ago.

Because a whole different asset class is beginning to surge, and it’s already more profitable than cryptos have ever been…

The Options Market Is a $7 Trillion “Old Boys’ Club”

For decades, Wall Street firms and financial advisors have told you to stick with the “60-40” approach.

In other words, your portfolio should contain 60% stocks and 40% bonds.

This recommendation obviously doesn’t mention assets like cryptocurrency, collectibles or even physical gold.

It also conveniently leaves out the asset class that’s been responsible for some of Wall Street’s biggest gains … options.

Because of how options are priced, when the stock makes a move, you can make as much as 5X, 10X, 20X and even 25X bigger gains than the stock.

This is where the world’s largest institutional investors play. Investment banks, hedge funds, life insurance companies, traditional banks, private equity … these firms make up 97% of the options market.

To this day, Main Street investors only take home a small slice of the profits generated by the world’s $7 trillion market for stock options.

In other words, Wall Street is urging you to “do as I say, but not as I do,” hoping you’ll settle for less-than-stellar returns.

But over the last decade, options trading has become increasingly popular. With the introduction of 0DTE options in 2022, retail investors gained unprecedented freedom in how they traded their options.

As a result, the options market had become even bigger than the futures market by October 2023:

Source: Bloomberg.

Options trading surged 478% between 2013 and 2023, nearly 4X the growth in the futures market.

Volume has exploded to record highs … with more than $7 trillion a year flowing in and out of options.

To meet this skyrocketing demand, Wall Street just launched a new options trading exchange…

That’s the 17th options exchange in the U.S.!

So the profit potential for options investors is vast — and it’s growing every day, even if Wall Street doesn’t want you to know that.

But if you’re going to be successful in the long term, it’s critical to avoid “options fever.”

Practice Caution When You Cash in on Options

Just like Bored Ape NFTs and failed cryptos, the options market has plenty of its own bad investments.

Depending on which metric you use, somewhere between 30% and 80% of all options expire worthless.

And due to the way derivatives like options work, you can still lose money even if a trend goes your way.

That’s part of the reason why so many Main Street investors are wary about using options more regularly. Many try options once or twice, lose a small amount of money without knowing exactly why, and then never trade this powerful asset class again.

That’s also why I spent years refining a unique trading system I call “The Money Code”…

The Money Code is designed to simplify options trading — maximizing your gains by focusing on high-momentum opportunities and giving you specific guidance on options trades to cash in on them.

My goal was to make options trading simple and easy for anyone who wants to learn how to trade and take a shot at making a boatload … even if they’ve never traded a dime.

You can get all the details on my Money Code HERE.

To good profits,

Adam O’Dell

Chief Investment Strategist

Credit: Source link