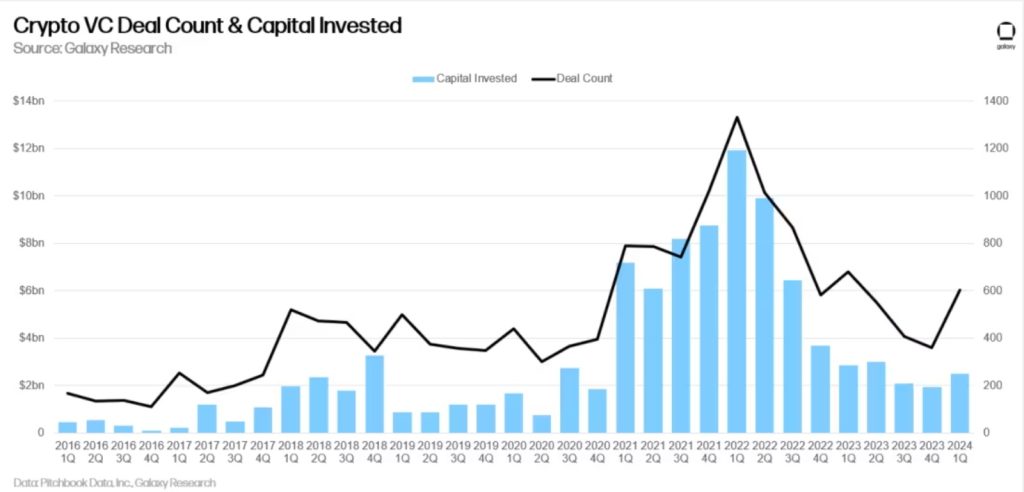

Venture capital investment in crypto and blockchain startups rebounded sharply in the first quarter of 2024, reversing a three-quarter trend of decline. According to Galaxy Research, investors poured $2.49 billion into the sector across 603 deals, representing a 29% increase in funding and a 68% rise in deal count compared to the previous quarter.

This surge could signal the beginning of a sustained recovery, although Galaxy Research cautions that further quarters of growth are needed for confirmation. The report highlights that this was the first rise in both capital invested and deal count in 3 quarters potentially indicating a turning point after a difficult 2023. However, sustained growth over the coming quarters will be crucial to solidify this positive trend.

Factors Driving the Investment Surge Into Blockchain Startups

Several factors are believed to have contributed to the Q1 investment surge. The introduction of Bitcoin exchange-traded funds (ETFs) is seen as a potential driver, alongside advancements in areas like restaking, modularity, and Bitcoin layer-2 solutions. Macroeconomic factors, such as interest rates, also play a role in investor decisions.

Interestingly, the historical correlation between Bitcoin prices and venture capital activity appears to be weakening. While Bitcoin has experienced significant price increases recently, venture capital investment remained stagnant until the Q1 2024 surge. Notably, investment levels haven’t yet reached the heights observed when Bitcoin surpassed $60,000.

The report further reveals that early-stage startups were the primary beneficiaries of this investment surge, attracting 80% of the total capital in Q1. Conversely, later-stage companies faced a more challenging environment, with many larger venture capital firms exiting the crypto sector or significantly reducing their investments.

The infrastructure sector dominated investment activity within the industry, capturing 24% of the total capital raised in the quarter. A prominent example is EigenLayer’s $100 million funding round. Web3 and trading sectors followed closely, capturing 21% and 17% of the total capital, respectively.

Global Landscape and Remaining Challenges

The United States maintained its position as a global leader in crypto venture capital. American startups participated in 37.3% of all deals and secured 42.9% of the invested capital. Singapore followed with a 10.8% share of total deals, while the United Kingdom held 10.2%. Switzerland and Hong Kong also emerged as significant players with 3.5% and 3.2% shares, respectively.

However, challenges remain for the industry. Galaxy Research emphasizes that fundraising conditions are still difficult due to ongoing macroeconomic uncertainties and unclear regulations. The report notes that “investors widely believed that rates would come down significantly over 2024,” but due to persistent inflation, these expectations have been tempered, leading to a cautious investment environment for venture capitalists.

Despite these hurdles, the Q1 2024 surge in venture capital activity for crypto and blockchain startups represents a positive step forward. Continued growth and a supportive regulatory environment will be crucial determinants for the long-term health of the industry.

Credit: Source link