Here’s what data suggests regarding which of USD Coin (USDC) and Tether (USDT) do institutional stablecoin investors prefer.

Average Transaction Size For USDC Is Greater Than USDT

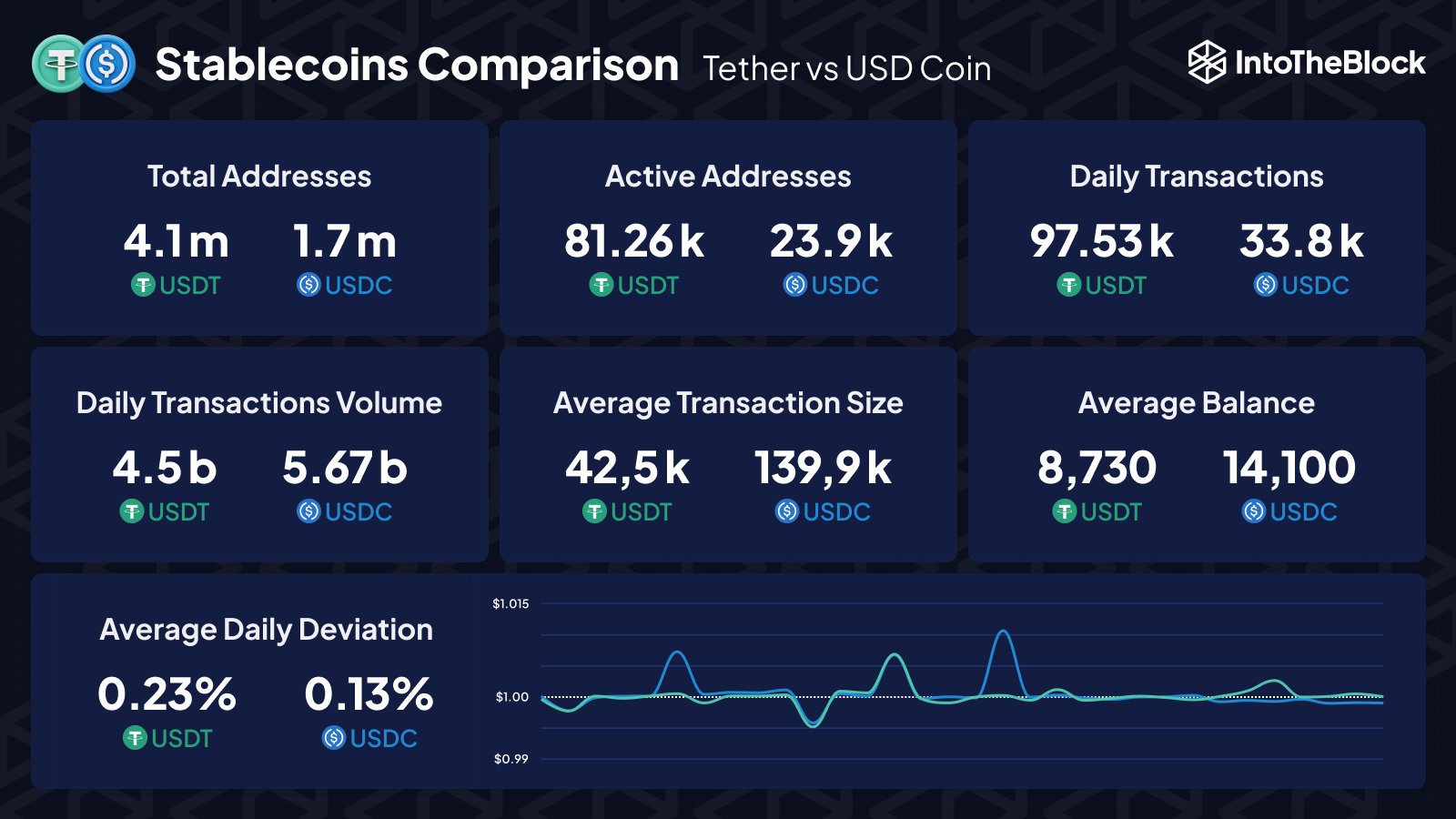

In a new post on X, the market intelligence platform IntoTheBlock has discussed how the metrics related to the two largest stablecoins in the sector compare against each other.

This is the data that IntoTheBlock has shared:

The different indicators related to USDC and USDT, compared | Source: IntoTheBlock on X

The first metric being compared here is the total addresses, which USDT wins out on as the stablecoin has 4.1 million addresses, while USDC has only 1.7 million, less than half of what USDT has.

In terms of active addresses, the former has the latter beat. The “active addresses” here refer to the total number of addresses participating in transaction activity on the chain.

The active addresses can be considered analogous to the unique number of stablecoin users, so Tether receives almost four times the traffic that USD Coin is.

As there are more active users, the total number of transactions involving USDT is also higher. Things change, however, when looking at the transaction volume. That is the total amount of tokens being moved with these transfers.

USDC seems to have a volume of 5.67 billion, while USDT has 4.5 billion. Interestingly, although the daily total number of Tether transactions is about three times the USD Coin transfers, the latter still has a notably higher volume.

There is only one conclusion here: the average size of each transaction is higher for USDC than USDT. And indeed, as the average transaction size metric puts it in numbers, transfers of the former see the movement of around $140,000 worth of tokens on average. In comparison, the latter’s transactions move only $42,500.

The average USDC wallet balance is also more than the USDT one. “These differences suggest that USDC is the preferred stablecoin for larger traders and institutional entities, whereas USDT is favored among retail users,” explains IntoTheBlock.

The table also compares the average daily deviation that these stablecoins experience in their prices, and it would appear that both of these stables generally move relatively flat as their deviations remain minor.

While USD Coin may have a higher concentration of large investors, there is nonetheless the simple fact that Tether is the much more popular stablecoin overall, reflected in its market cap.

USDT is a couple of spots above USDC | Source: CoinMarketCap

USDT is currently the third largest cryptocurrency in the sector, only below Bitcoin (BTC) and Ethereum (ETH). USDC, on the other hand, is number six on the market cap list, behind BNB (BNB) and XRP (XRP) in 4th and 5th, respectively.

BTC Price

At the time of writing, Bitcoin is trading around $29,900, up 2% in the last week.

BTC seems to be having trouble breaking above the $30,000 mark | Source: BTCUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, IntoTheBlock

Credit: Source link